Issue #4 Black Dawg Says Japan Inc. at Dawn of New Age; Buffet and Jefferies Concur

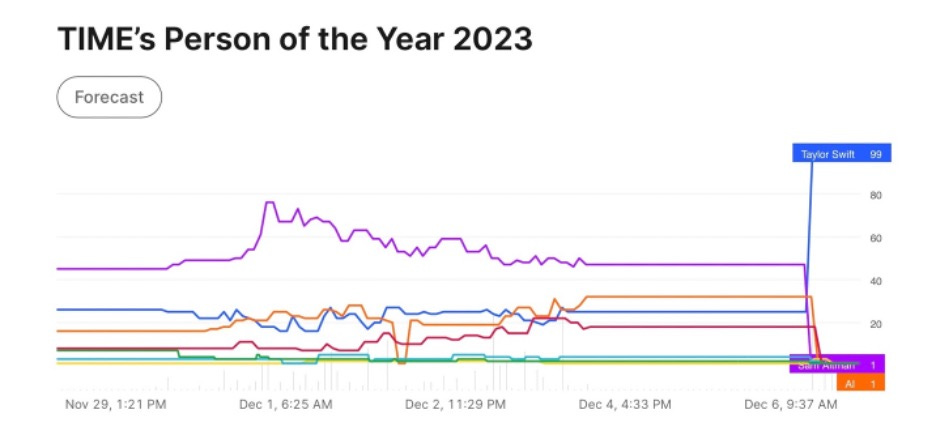

Congratulations Swifties and/or prediction market junkies! If you placed a bet on Kalshi.com, a CFTC regulated binary (Y/N) event contract market, on Taylor Swift being named Time Magazine Person of the Year, you made a 426% return! More coverage of the exciting world of prediction markets in future issues.

Market Indices:

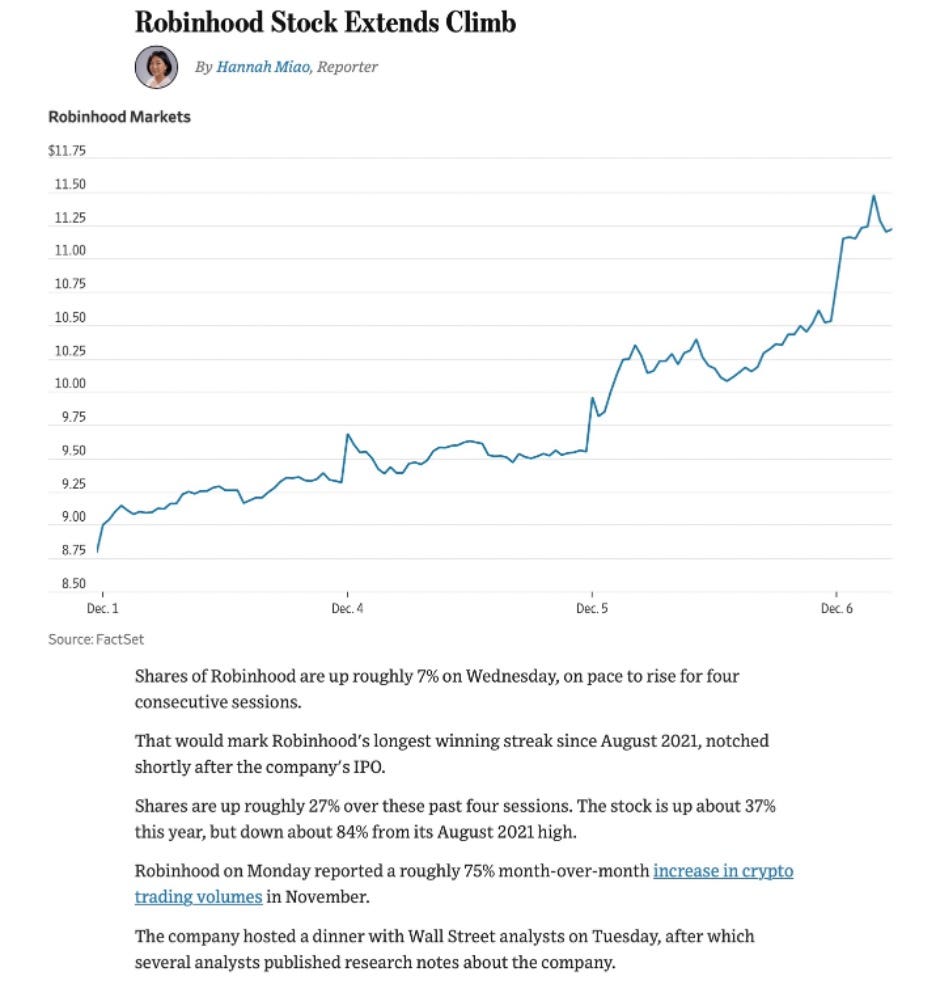

Stocks Up on Unusual Volume: $HOOD … Could it be Vlad’s new haircut?

Also on the upside, auto giant $STLA Stellantis nears an all-time high, yet still looks cheap trading at a PE of 3.

Stocks Down on Unusual Volume: $BF.B

Daddy made whiskey and he made it well. Unfortunately for Brown-Forman, today’s worst performer in the S&P 500, whiskey sales fell year over year including a 5% drop in Old Forester sales. I expect @Sonny and I could help volumes recover in 2024.

Black Dawg knows it’s a thing and here to stay, but just doesn’t have a lot of value to add on the subject. This hasn’t stopped him from opining before though you say.

Lack of regulation and transparency are among his concerns. As @Lorenzo knows, the concentration of ownership combined with a lack of disclosure regime is Black Dawg’s biggest red flag. Essentially, insider trading of digital assets is not disclosed and manipulation is not illegal absent characterization as fraud.

However, Black Dawg is happy for @StoneJackBaller who said he had bought BTC for his descendants 300 years from now.

If your time frame is shorter you may want to watch out for the mother of all sell the news events when a bitcoin ETF gets SEC approval.

Speaking of long timeframes…

The Rise of Temu’s Chinese Parent Will Reshape E-Commerce

$PDD, the owner of fast-growing Temu, is muscling into the U.S. in a way Alibaba never did. Wall Street Journal.

Black Dawg did not mean to come off as anti-clean energy yesterday especially with an internationally renowned solar energy expert in the house. Black Dawg found this energy storage company that he is sniffing:

https://fluenceenergy.com/energy-storage-technology/

THIS DAY IN HISTORY:

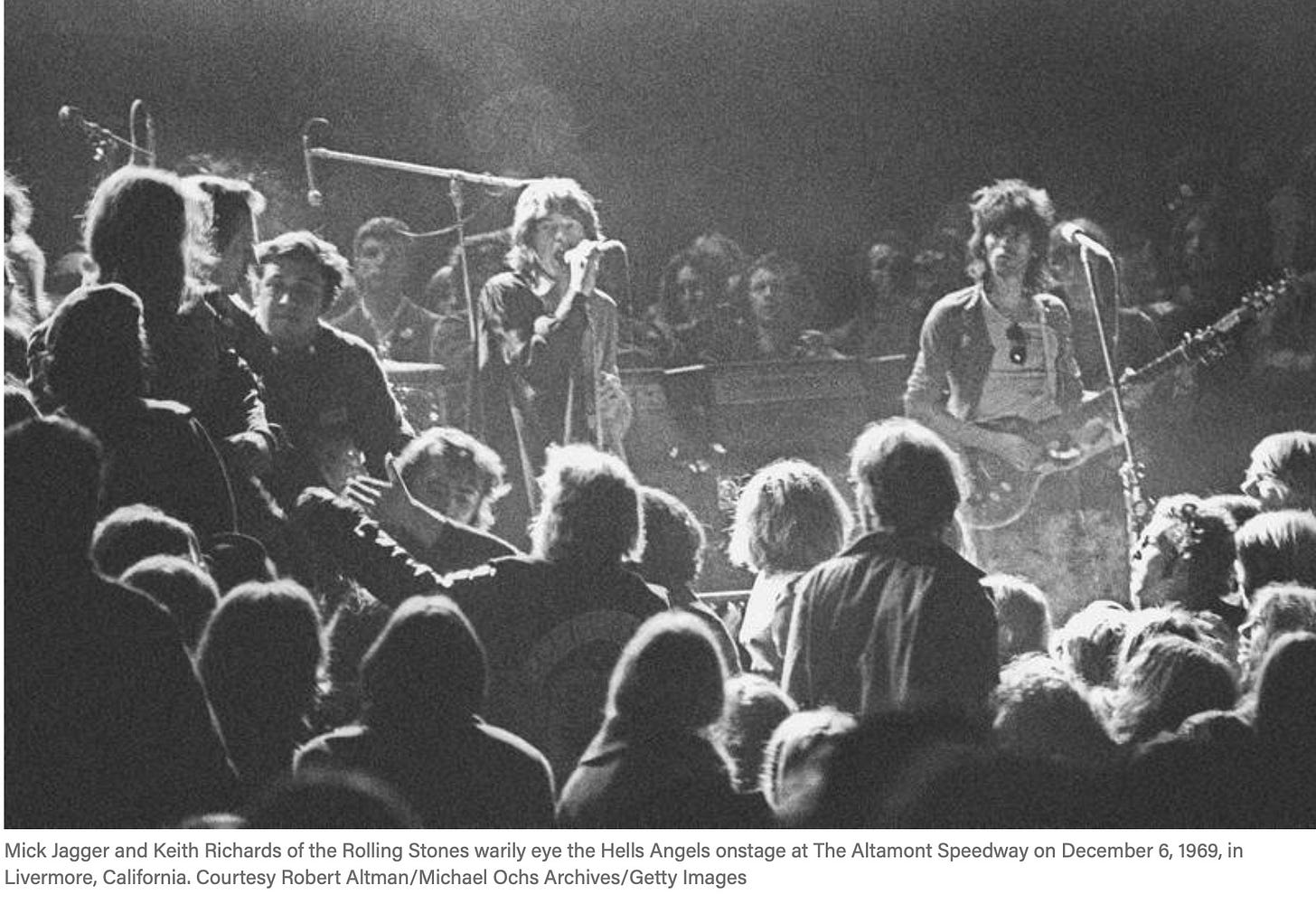

In 1969, a free concert by The Rolling Stones at the Altamont Speedway in Alameda County, California, now referred to as the death of the ‘60s, was marred by the deaths of four people, including one who was stabbed by a Hell’s Angel in front of Mick Jagger while he was singing Under My Thumb.

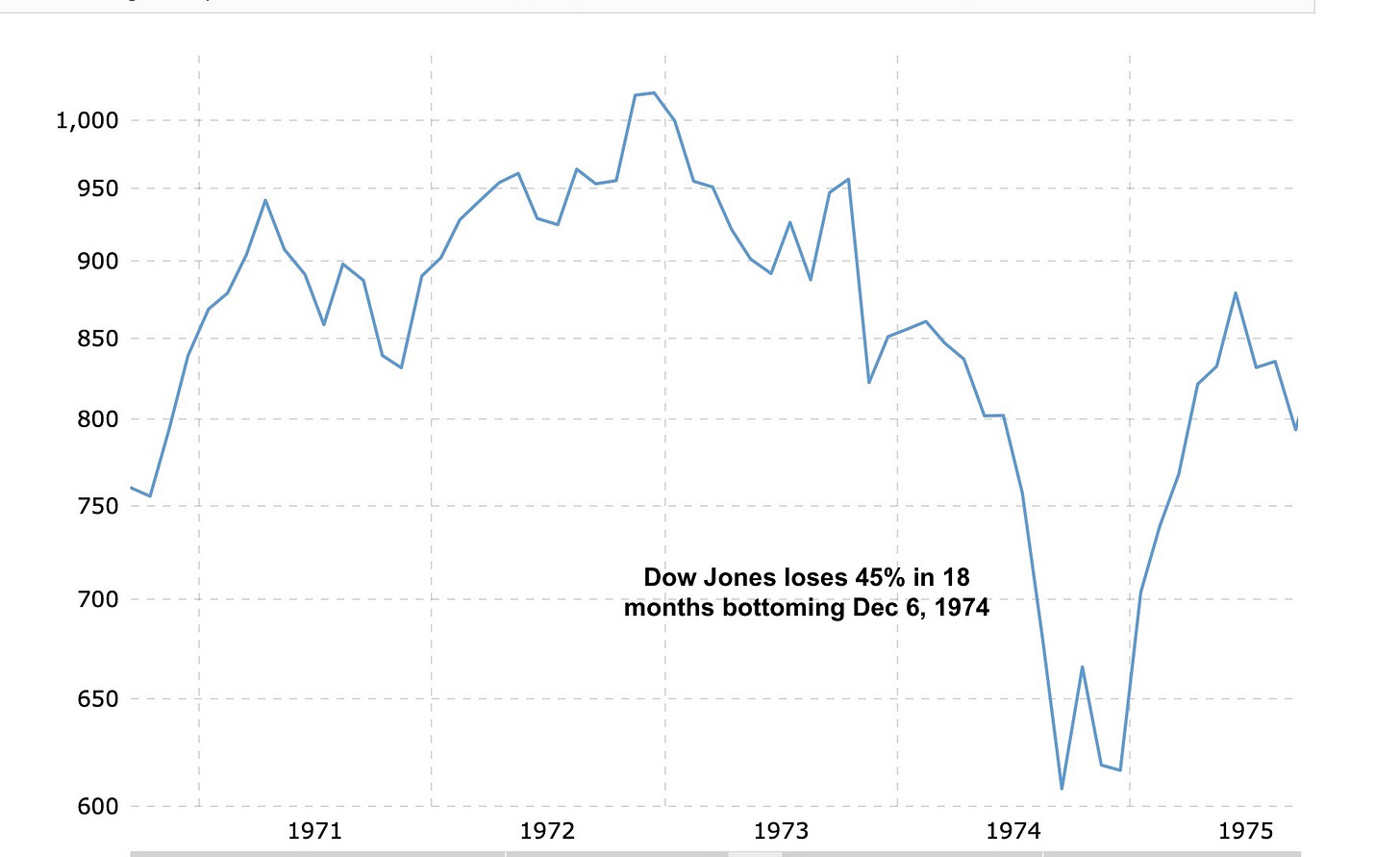

In 1974, the Dow Jones Industrial Average fell to a low of 577.60, marking a 45% decline from the highs in early 1973. This marked the bottom of the 1973-1974 bear market. That’s what my British colleague would call a right proper bear market. The Dow Jones closed at 36054 today up some 6138% over the last 49 years.

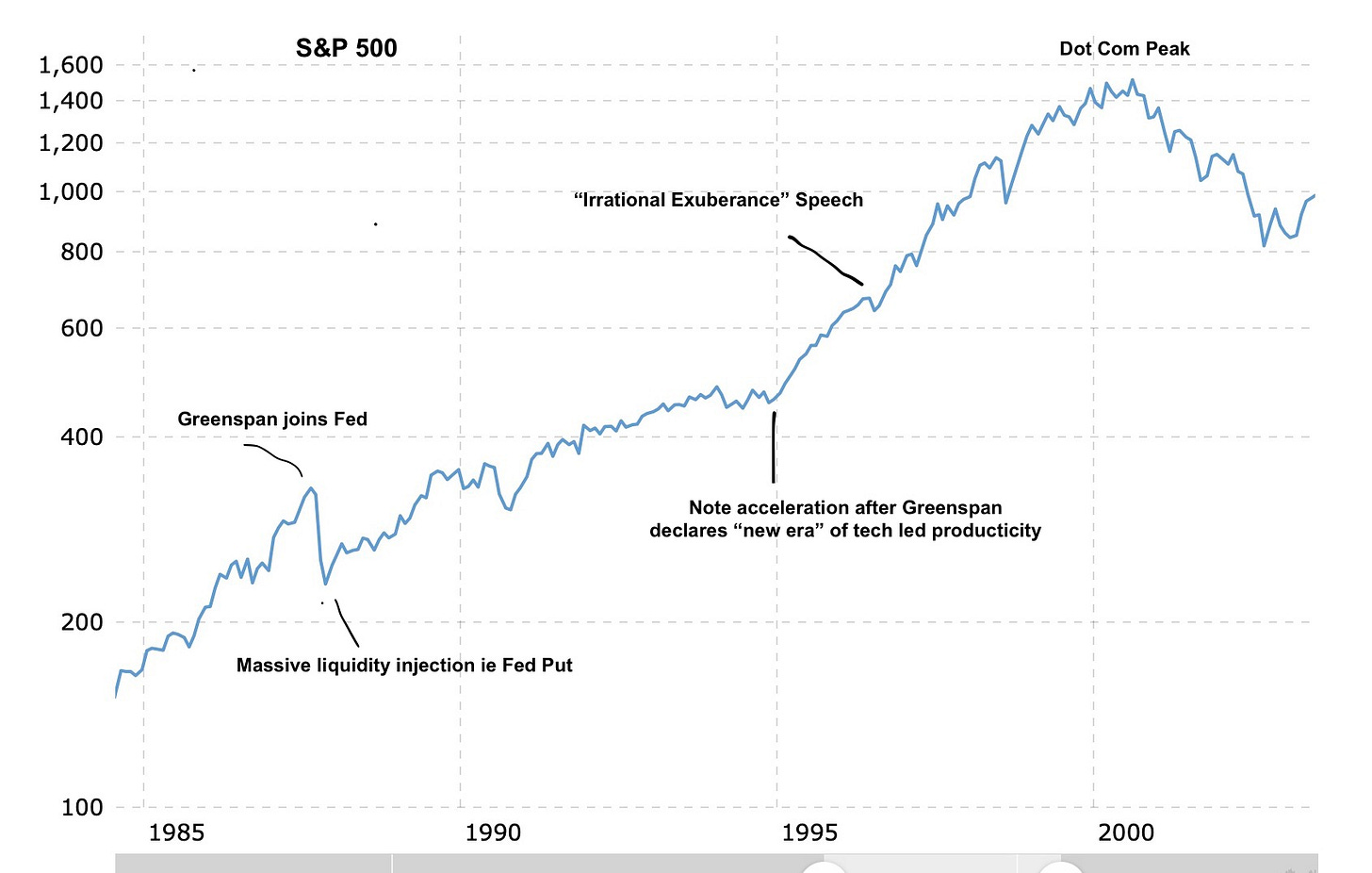

1n 1996, Fed Chair Alan Greenspan a/k/a the founding father of American moral hazard, gave a really boring speech except when he mumbled the following: “how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

The market, which Greenspan apparently thought was expensive, shuttered on news of the speech but went on to double (S&P 500) or triple (Nasdaq) from the date of the speech to a historic top in 2000. In later years he would claim bubbles can only be determined in hindsight.

Which segways nicely into our (Human) Behavioral Economics Concept of the Day:

Irrational Exuberance: The state of excessive optimism and excitement in financial markets or economic conditions, leading to inflated asset prices and unsustainable market behavior. It can lead to poor performance by causing individuals to overlook fundamental valuations and engage in speculative or risky investments.

Op-Ed

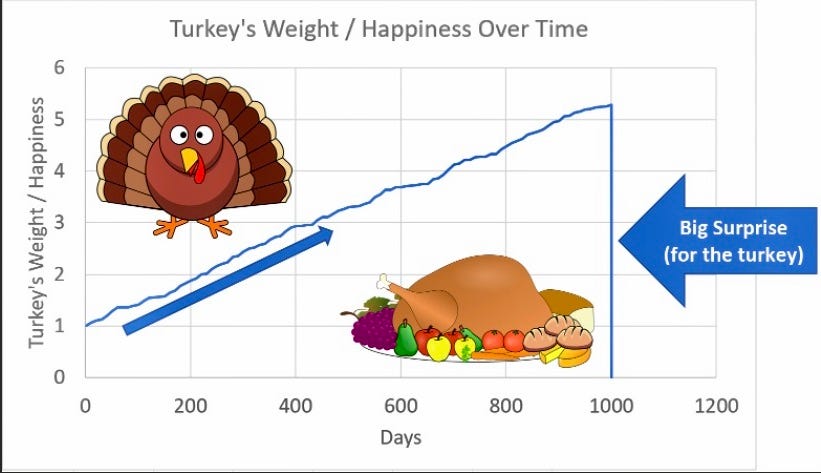

Speech calling for genocide is against international law, but at elite Ivy League schools apparently it depends on the context and whether it turns into action. I give Harvard, Penn and MIT Presidents an F in yesterday’s Congressional testimony on campus hate. Investor Bill Ackman, who parlayed his Harvard paper into prominence and billions of dollars, is calling for resignations before the value of Ivy League paper resembles the Turkey Problem chart:

https://nypost.com/2023/12/06/news/bill-ackman-demands-harvard-penn-mit-presidents-to-resign/

And, yes, Black Dawg reads the New York Post, among other more erudite publications.