Bloomberg Economics: Impact of China-Taiwan Military Conflict Would Be Ginormously Huuuge

Cost in Blood, Treasure Enough of a Deterrence?

Anti-landing barriers on the Taiwanese islands of Kinmen, across from Xiamen in mainland Bloomberg

Taiwan Military Conflict Would Cost $10 Trillion

In case you were running out of things to worry about, Taiwan’s presidential election January 13 highlights the potential for a conflict that would decimate the global economy according to Bloomberg Economics.

Bloomberg Economics, in a first of its kind study, estimates the price tag of a military conflict between China and Taiwan at around $10 trillion, equal to about 10% of global GDP — dwarfing the costs of war in Ukraine, the Covid pandemic and the Global Financial Crisis.

While few put a high probability on an imminent Chinese invasion, a wide variety of players in markets, industry and government are increasingly looking at hedging risk.

Taiwan makes most of the world’s advanced logic semiconductors. Globally, 5.6% of total value added comes from sectors using chips as direct inputs — nearly $6 trillion. Total market cap for the top 20 customers of chip giant Taiwan Semiconductor Manufacturing Co. is around $7.4 trillion. In addition, the Taiwan Strait is one of the world’s busiest shipping lanes, Bloomberg notes.

The biggest hit to the global economy from a conflict would come from missing semiconductors. Factory lines producing laptops, tablets and smartphones — where Taiwan’s high-end chips are the irreplaceable “golden screw” — would stall. Autos and other sectors that use lower-end chips would also take a significant hit.

In the case of a war, Taiwan’s economy would be decimated with an estimated 40% hit to GDP while China’s GDP would suffer a 16.7% decline. US GDP would drop 6.7% with global GDP down 10.2%. Bloomberg Economics also modeled a yearlong blockade of Taiwan. For Taiwan, GDP would be down 12.2%. For China, the US, and the world as a whole, GDP would be down 8.9%, 3.3% and 5% respectively.

The pro-US candidate Lai Ching-te — currently serving as vice president in the Democratic Progressive Party administration — is leading in the latest and final presidential polls. In the past, he described himself as a “for Taiwanese independence.” Beijing, which views the island as part of its territory, has expressed deep concern about the possibility of a Lai win, according to a senior administration official.

US officials say China may be planning a reaction to the election, with military incursions, economic sanctions and grey zone tactics like cyber-attacks. Xi has said that Taiwan is not an issue that can be “passed down generation after generation.” Along with his efforts to modernize the military, those statements have spurred speculation he wants to deliver unification. President Biden has unambiguously said the US would come to Taiwan's aid in the event of a Chinese invasion.

Legendary investor Warren Buffett sold his stake in Taiwan Semiconductor in the first quarter of 2023, citing geopolitical risk as the reason.

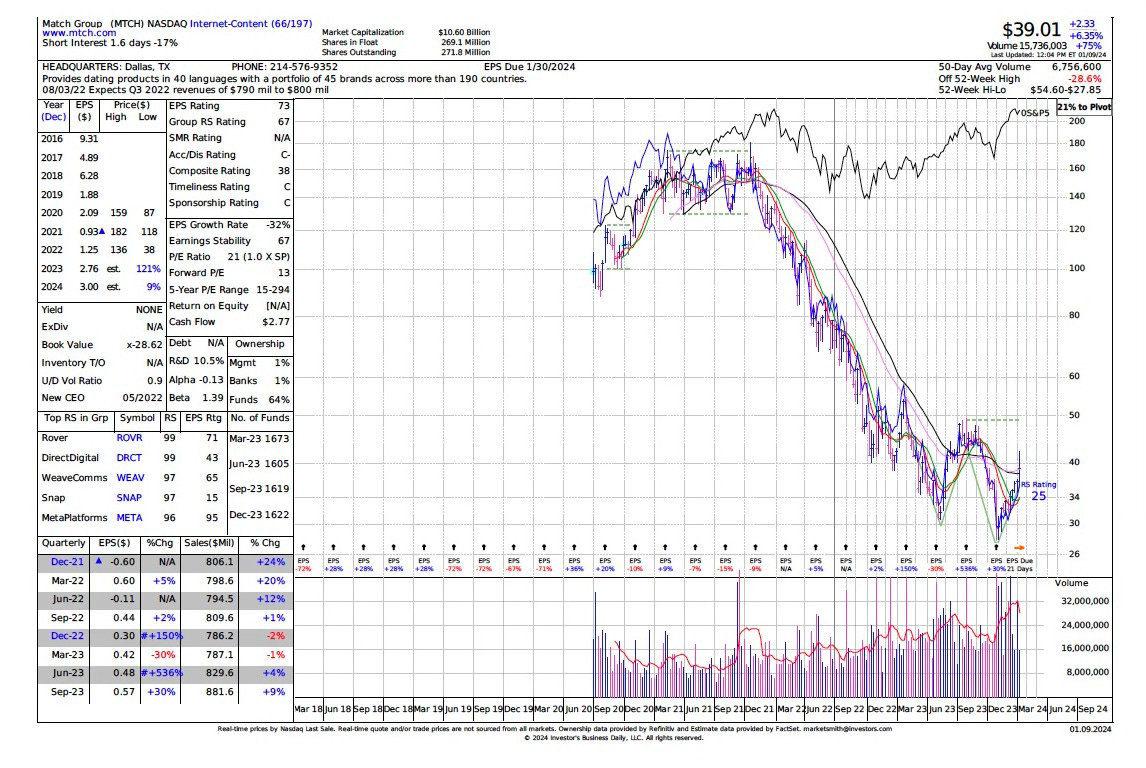

Hedge fund giant Elliott Management has taken a 10% stake in dating app Match.com $MTCH worth $1 billion.

The $55 billion fund’s outstanding long term track record draws Blackdawg’s attention when they make moves. Elliott knows value and, as an activist, knows how to unlock it through improved performance. Match.com fell from $180 in 2021 to less than $30 at the end of last year. Investors that got too excited about the filing news and paid up (+15%) premarket may have some short term regret (closed +3%) but $MTCH looks like a deep value play to Blackdawg and Elliott is likely in it for the long haul. The stock currently trades at 13x forward earnings estimates which is lower than at any time in the last 5 years.

JPM Asset & Wealth Management is out with 2024 forecasts.

JPM says leading indicators point to slowing growth but not a collapse. Even if we do fall into recession it shouldn’t be deep or mean stocks would fall much. Instead, 2024 looks like a year of slowing GDP growth, single-digit earnings growth and single-digit returns on the median S&P 500 stock.

Accordingly, JPM is recommending a diversified portfolio of cash, long-duration government bonds, high quality corporate bonds and equities. Industrials and energy look interesting given US industrial policies, and – blatantly copying Blackdawg’s forecast - so does Japan. From a sector perspective, industrials and energy look interesting in addition to technology.

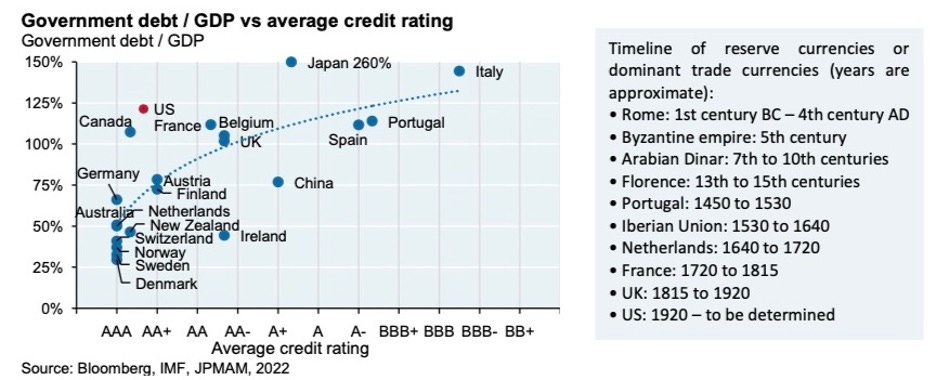

Large US fiscal deficits and the impact of new US energy (building redundancy) and industrial policies (nationalizing semiconductor supplies) pose longer term inflation risks.

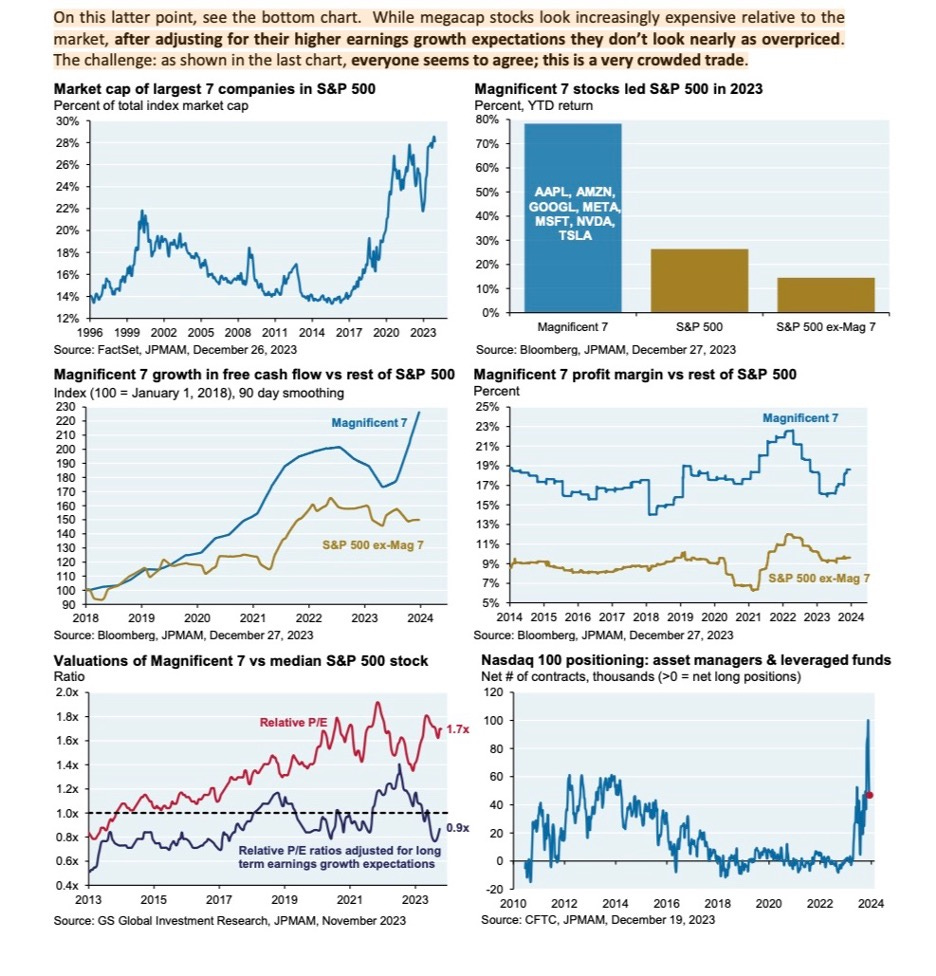

JPM sees continued outperformance of megacaps. Apparently they read Blackdawg’s piece on how the largest tech companies are leading for good reason – they are more profitable and growing faster. “While megacap stocks look increasingly expensive relative to the market, after adjusting for their higher earnings growth expectations they don’t look nearly as overpriced.” Something to keep in mind – the bigger the companies get, the greater the antitrust risk. In addition, the crowdedness of the Mag 7 trade concerns Blackdawg.

While the prospects for investing in China remain dismal, JPM says “if you had a multiyear time horizon and believed that China will eventually take demand side or supply side steps to end its current malaise, a long position could be rewarding.” Blackdawg loves value but cannot see the light at the end of the tunnel and worries that when he does it may be a train.

The USD enjoys a privileged status as a reserve currency (lowering funding costs) although history teaches that no reserve currency lasts forever.

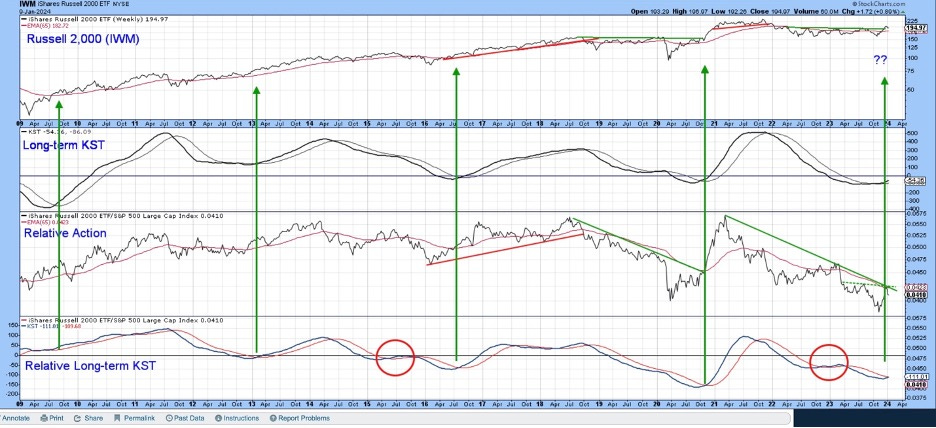

Technical analyst Martin Pring sees an increased liklihood of a multi-month rally in small cap stocks although as he notes their decade long underperformance has seen its share of false dawns. His current outlook is for continued weakness but thinks we are approaching a make or break moment with the weight of the evidence favoring a reversal.

Free Lunch?

The California State Teachers’ Retirement System (CalSTRS) may borrow against up to 10% of its $318 billion portfolio “on a temporary basis to fulfill cash flow needs in circumstances when it is disadvantageous to sell assets,” Bloomberg reports, citing a policy document from the country’s second-largest pension fund. Such action would be used only as an “intermittent tool” for portfolio management. Illiquid investments have been under pressure. The venture capital industry managed just $61.5 billion of exit volume in 2023, a fraction of the $797 billion achieved during the two years prior. Similarly, global private equity exits slumped to $592 billion, respectively, over the first nine months of last year. That compares to roughly $1.8 trillion across full-year 2021.

This Day in History:

Behavioral Economics Principle of the Day

Information Bias: The tendency to seek out more information than necessary or relevant when making decisions. It can lead to irrational behavior by causing individuals to feel overwhelmed or confused by excessive information, leading to decision paralysis or distorted judgments.