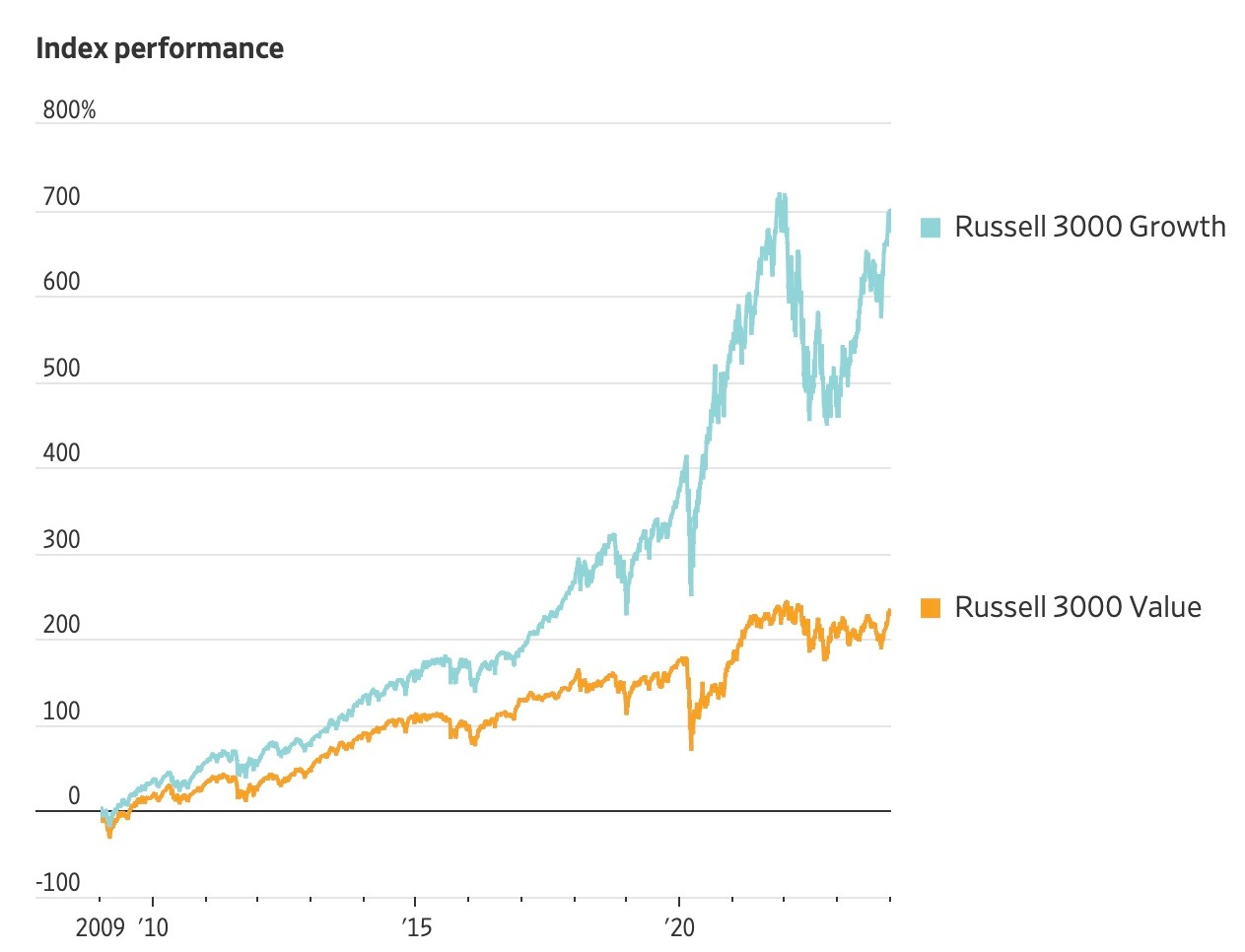

The Death of Value?

The performance of growth companies have trounced that of value companies following the Great Financial Crisis prompting some to posit that value investing is dead. The popularity of high quality growth stocks has reached a level where valuations no longer permit the strategy popularized by investing legend Charlie Munger and later Warren Buffet – buying great businesses at fair prices. Instead, even Munger admitted recently that to keep up today one must own some of the tech leaders almost regardless of price. https://www.wsj.com/finance/stocks/value-investing-growth-charlie-munger.

Insiders, presumably the most knowledgeable regarding their own company’s value, are much more interested in selling than buying their shares after the late 2023 rally.

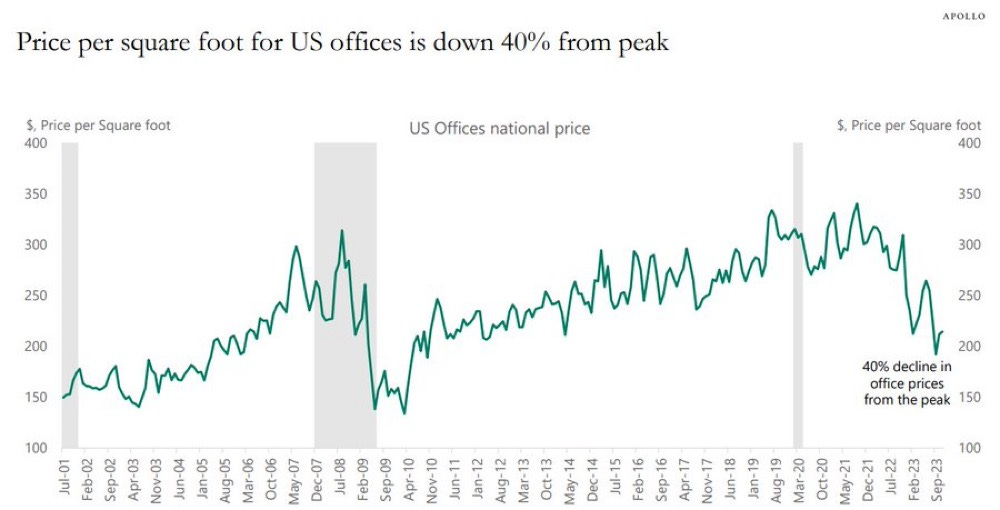

Commercial real estate is downright ugly. Vacancies soar (20%) —> prices plummet (-40%) + levered asset class = a lot of yet to be realized losses.

Behavioral Economics Principle of the Day

Regret Aversion: The tendency to avoid actions or decisions that may lead to feelings of regret, even if the potential benefits outweigh the potential costs. It can lead to irrational behavior by causing individuals to stick with familiar choices or avoid taking risks, limiting personal growth and exploration of new opportunities.