Michael, We're Bigger Than U.S. Steel

- Hyman Roth, Who Always Made Money For His Partners (Godfather Part II)

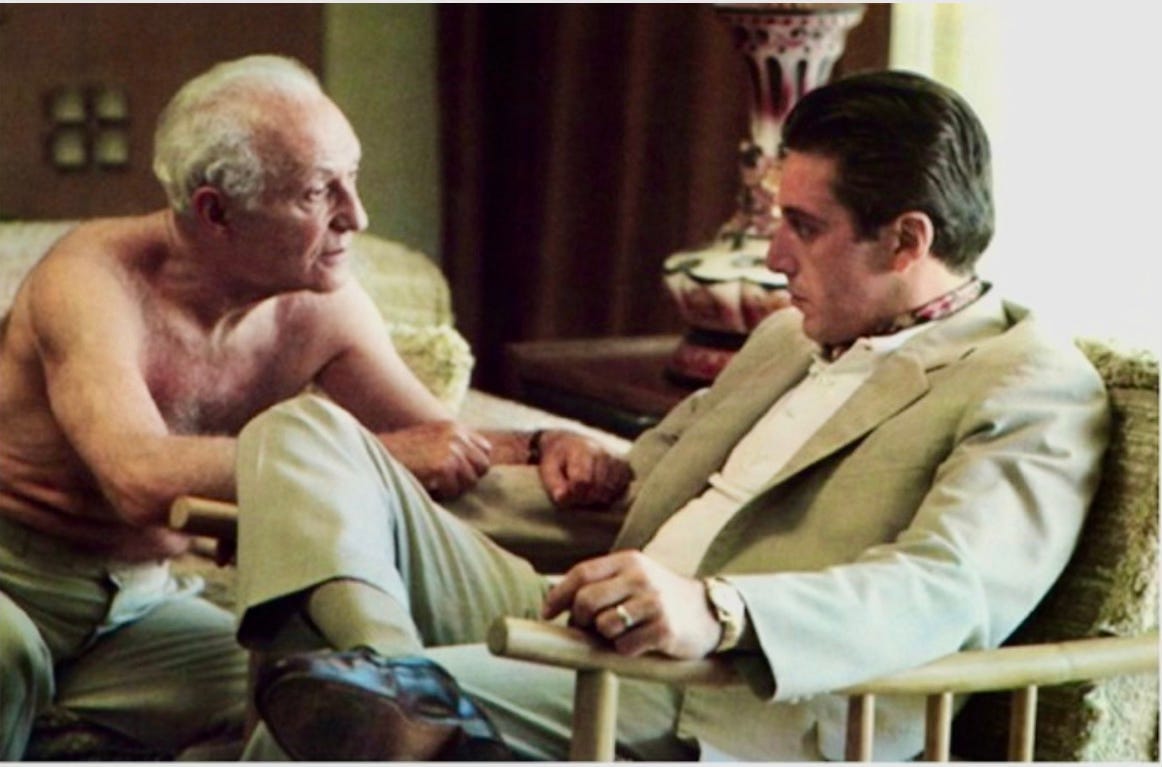

December 18 Recap:

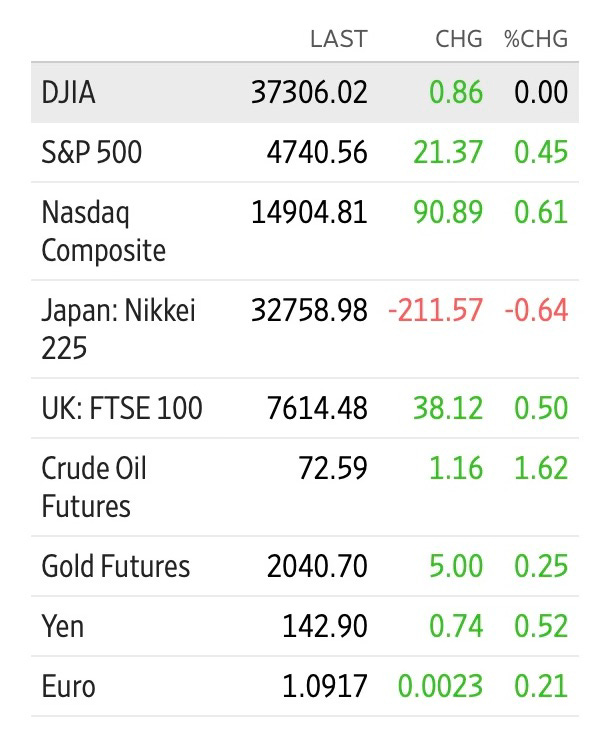

Japan's Nippon Steel won the bidding war for US Steel $X in an all-cash deal valued at $55 per share, or $14.9 billion including assumed debt. US Steel closed 26% higher. Losing US Steel bidder Cleveland Cliffs CLF 0.00%↑ rose nearly 10% as not only is the company not spending money in a competitive auction (acquirer’s stock typically falls especially of late) but it will spend that money on "more aggressive stock buybacks," CEO Lourenco Goncalves said. Wednesday’s edition of Black Dawg’s Long Money Wrap highlighted unusual activity in US Steel stock on reports of multiple bidders above $40 a share.

Two more Federal Reserve officials joined the central bank chorus pushing back against market expectations for the depth and timing of interest-rate cuts next year.

Insider Activity:

Following the publicly disclosed trades of company insiders can be profitable. It’s common sense that nobody knows a company better than insiders (defined by the SEC as officers, directors and 10% shareholders). Academic studies back this up:

"The Information Content of Aggregate Insider Trading" by Seyhun (1988).

"Why Does Aggregate Insider Trading Predict Future Stock Returns?" by Seyhun (1992).

"Are Insiders’ Trades Informative?" by Josef Lakonishok and Immoo Lee (1998).

Black Dawg has long followed the Baker brothers, Julian and Felix, the most successful life sciences investors of all time. https://www.bnnbloomberg.ca/baker-brothers-turn-biotech-prowess-into-a-3-8-billion-fortune. Following their investments, especially in companies with less than $10 billion in market capitalization, has proved to be a winning strategy. https://whalewisdomalpha.com/baker-brothers-holdings-13f-replication-strategy/index.html.

The Monster NASH: Hope for Liver Disease Treatment

The past several years have been tough sledding for biotech investors, but one green shoot may be the Baker bros becoming more active. Their fund made a number of purchases of life sciences company Madrigal Pharmaceuticals MDGL 0.00%↑ last week paying as much as $228 a share. The reason this caught Black Dawg’s attention, is that the stock had rallied almost $100 in the past 6 weeks before these purchases. That’s what long money do - ie looks forward, not backward. Black Dawg sees the Bakers paying up for MDGL 0.00%↑ as their bet that Madrigal’s Resmetirom will be the first FDA approved treatment for NASH, and that such approval may be forthcoming soon. If the Bakers are right, the company’s current $4.5 billion market capitalization seems small compared to the growth of the disease and the unmet need for treatment. The NASH treatment market is virtually non-existent (just over $1 billion at present) but is expected to grow 40-60% a year for a decade once drugs are approved. https://www.madrigalpharma.com/nash/

On a cautionary note, clinical stage pharma can be a crap shoot as a drug’s trial results tend to be binary see e.g., the headline from this morning: Structure GPCR 0.00%↑ Plummets 43% After Trailing Lilly In Obesity Treatment. IBD article. If interested in biotech, best to buy an ETF like $IBB, a basket of stocks or follow the informed $.

Turkey’s most powerful banker, Central Bank Governor Hafize Gaye Erkan, has to live with her parents because the rent is just too damn high. “Would Istanbul be more expensive than Manhattan? We could not find a house in Istanbul. Awesomely expensive. We settled in with my parents, we stay with them,” Erkan told a Turkish newspaper. Istanbul rents rose 77% last year.

This will be no surprise to good friend of Black Dawg and former US Treasury terror finance expert @Jonathan Schanzer https://twitter.com/JSchanzer/ who has written extensively on Turkey, its economy and the NATO “ally”’s role in supporting terror organizations such as Hamas. https://schanzer.pundicity.com/topics/191/turkey. You may recognize Dr. Schanzer from his appearances on major media networks or the numerous times he has testified before Congress. Today I checked out his daily podcasts covering the latest developments in the ongoing Gaza conflict featuring overnight news, expert analysis and insight and a daily guest interview with some of the most influential figures shaping policy today. Definitely worth checking out. https://www.fdd.org/fddmorningbrief.

Hou This?

Crude prices rose 2% on Monday following a series of attacks from Yemen’s Houthi rebels on ships passing through the Red Sea. Oil major BP on Monday said it would stop sending tankers through the Red Sea. Some of the biggest shipping companies, including A.P. Moller-Maersk and Hapag-Lloyd have decided to divert some ships.

Black Dawg was name dropping this weekend when someone asked who is Ray Dalio? That depends on your perspective, I suppose.

The founder of Bridgewater Associates, the world’s largest hedge fund with more than $200 billion in assets under management, Dalio started with an investment newsletter out of his Manhattan apartment (not nearly as entertaining as Black Dawg’s Long Money Wrap). He got his first break managing $5 million of international bonds for a Canadian institution.

Dalio was an early adopter of the portfolio allocation strategy of risk parity and the construction of an all-weather portfolio. Dalio believes in the importance of studying history because most scenarios one might encounter in markets have likely occurred in the past, just not necessarily within anyone’s living memory. For example, people today do not recall a time when the US dollar was not the world’s reserve currency. Of course this has not always been so as the former empires and their respective currencies of the Dutch, Spanish and English can attest.

Dalio guided his fund to a 10% return in 2008 when the financial world was melting down and US stocks fell 40%, after which money came flooding in to Bridgewater. In recent years he has published a collection of Principles to which he attributes his success for the benefit of mankind or womankind. https://www.principles.com.

A more critical view can be found in journalist Rob Copeland’s The Fund which portrays Dalio as an oft wrong, ego-maniacal petty tyrant who humiliated employees on the reg. https://www.nytimes.com/2023/11/06/books/review/the-fund-rob-copeland.

This Day in History:

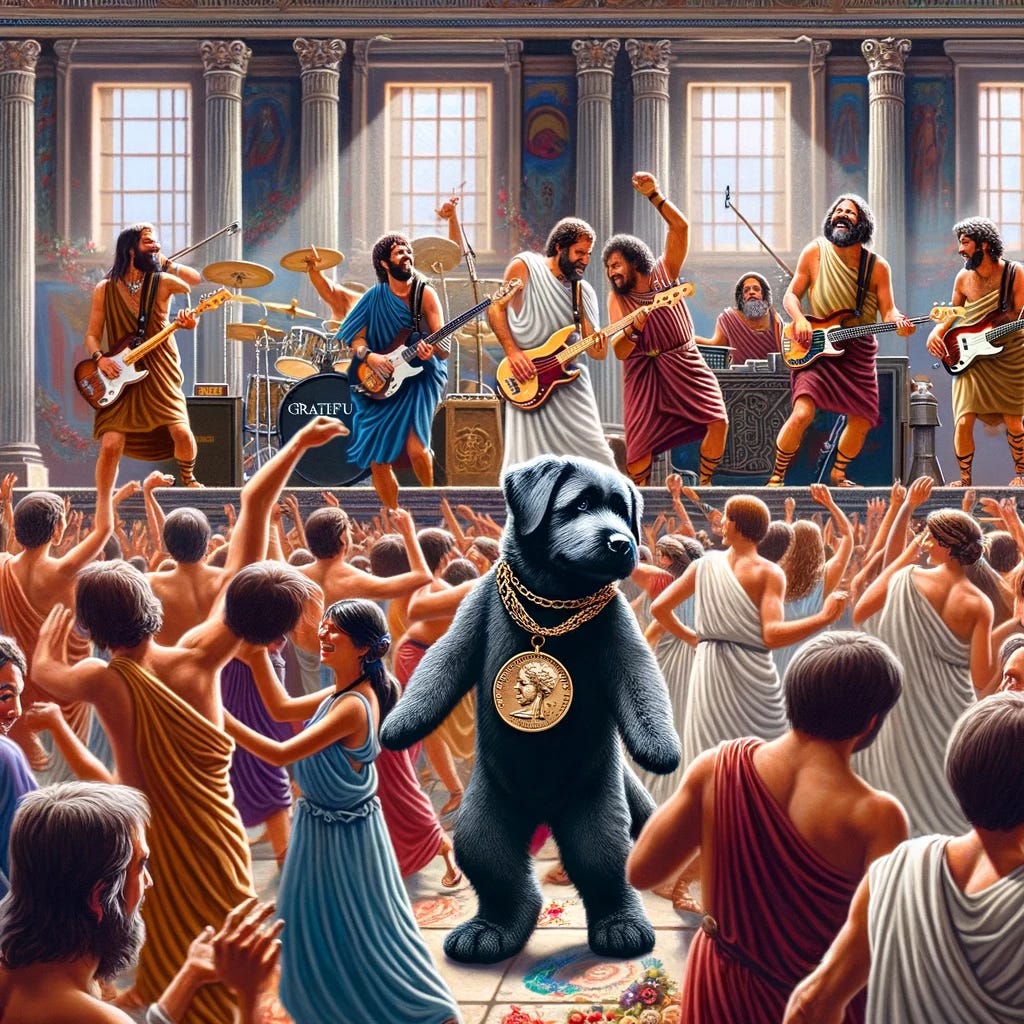

In 497 BC, the first Saturnalia festival was celebrated in Ancient Rome. Saturnalia was a 6 day long holiday in honor of the god Saturn celebrated with an atmosphere of merriment and continual partying.

Come the rockin' stroke of midnight, the place is gonna fly! - Bob Weir One More Saturday Night

Behavioral Economics Principle of the Day:

Sunk Cost Fallacy: The tendency to continue investing resources (time, money, effort) into a project or decision, even when it is no longer rational to do so. It can lead to poor performance by causing individuals to make decisions based on past investments rather than future prospects.