Mother of All FOMOs

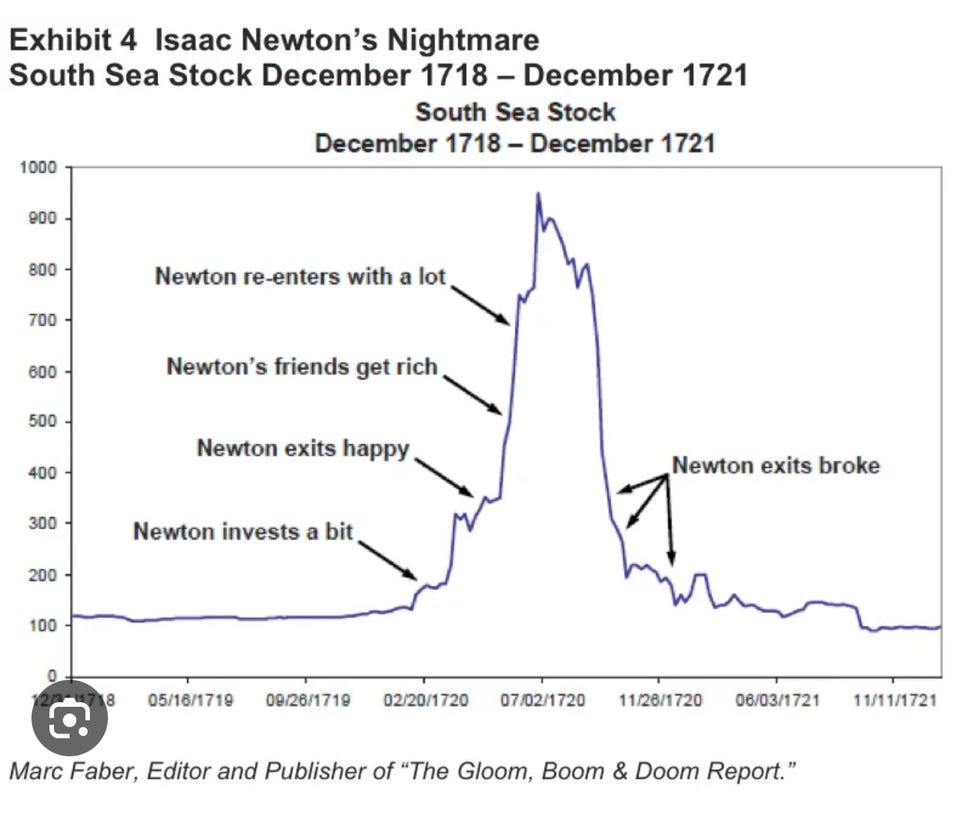

"I can calculate the movement of the stars, but not the madness of men.” - Sir Isaac Newton.

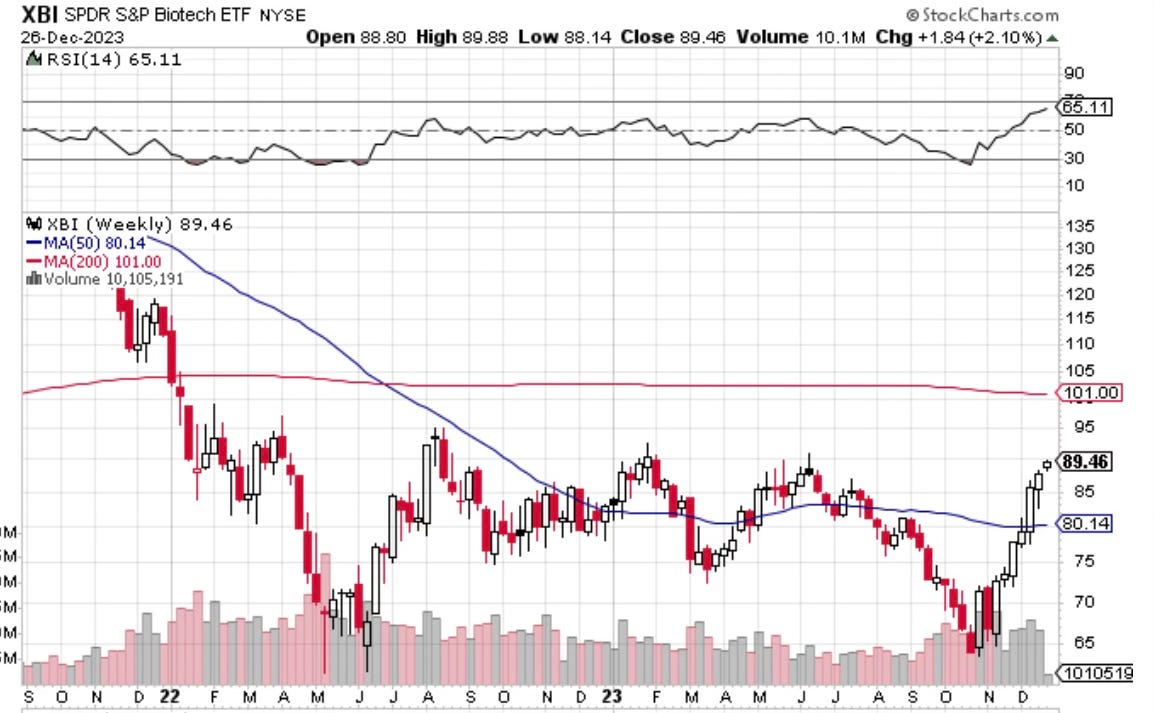

Biotech is back on merger wave, lower rates. https://www.barrons.com/articles/biotech-stocks-ma-deals.

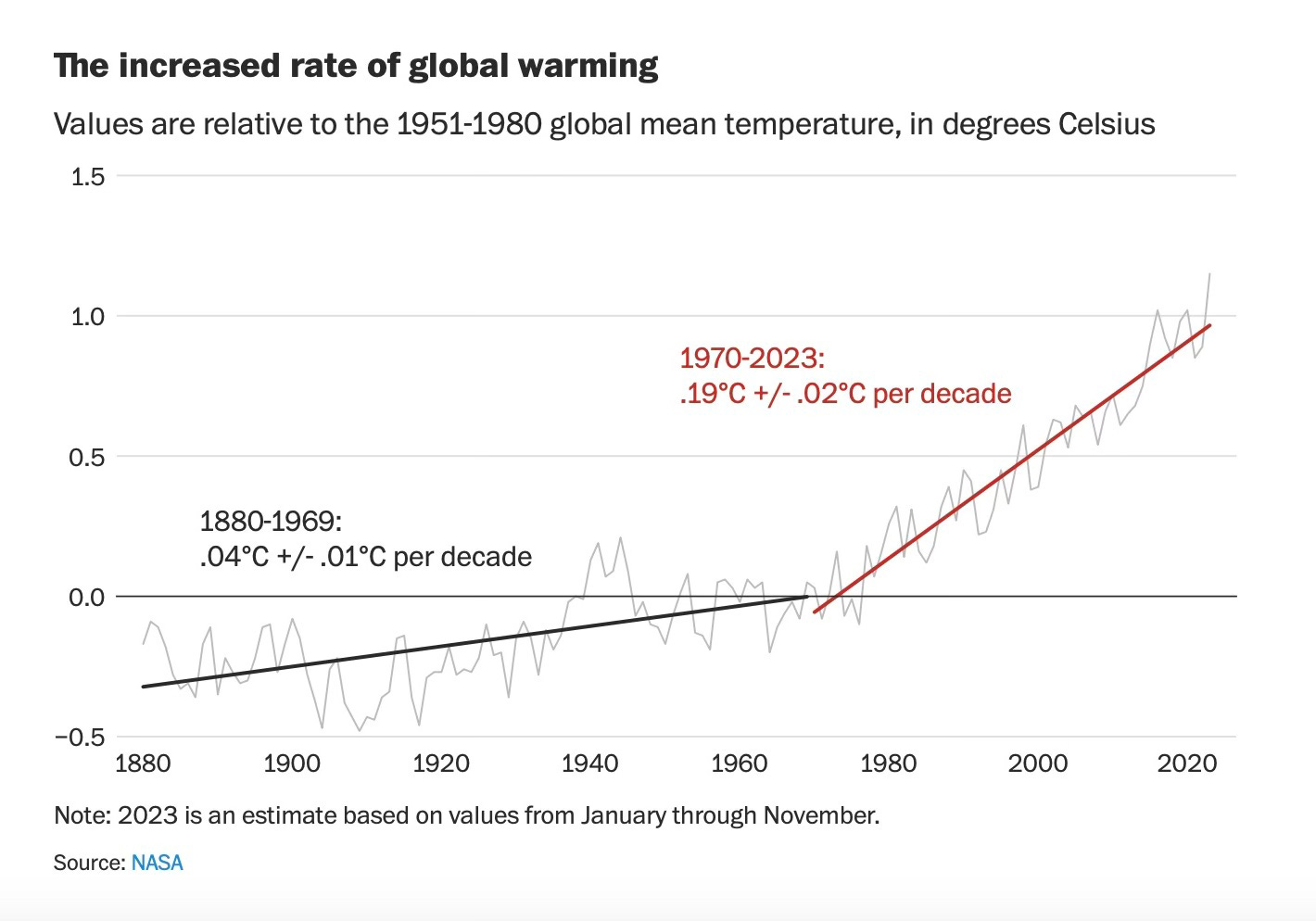

Is the pace of global warming heating up? https://wapo.st/3RWxf8A

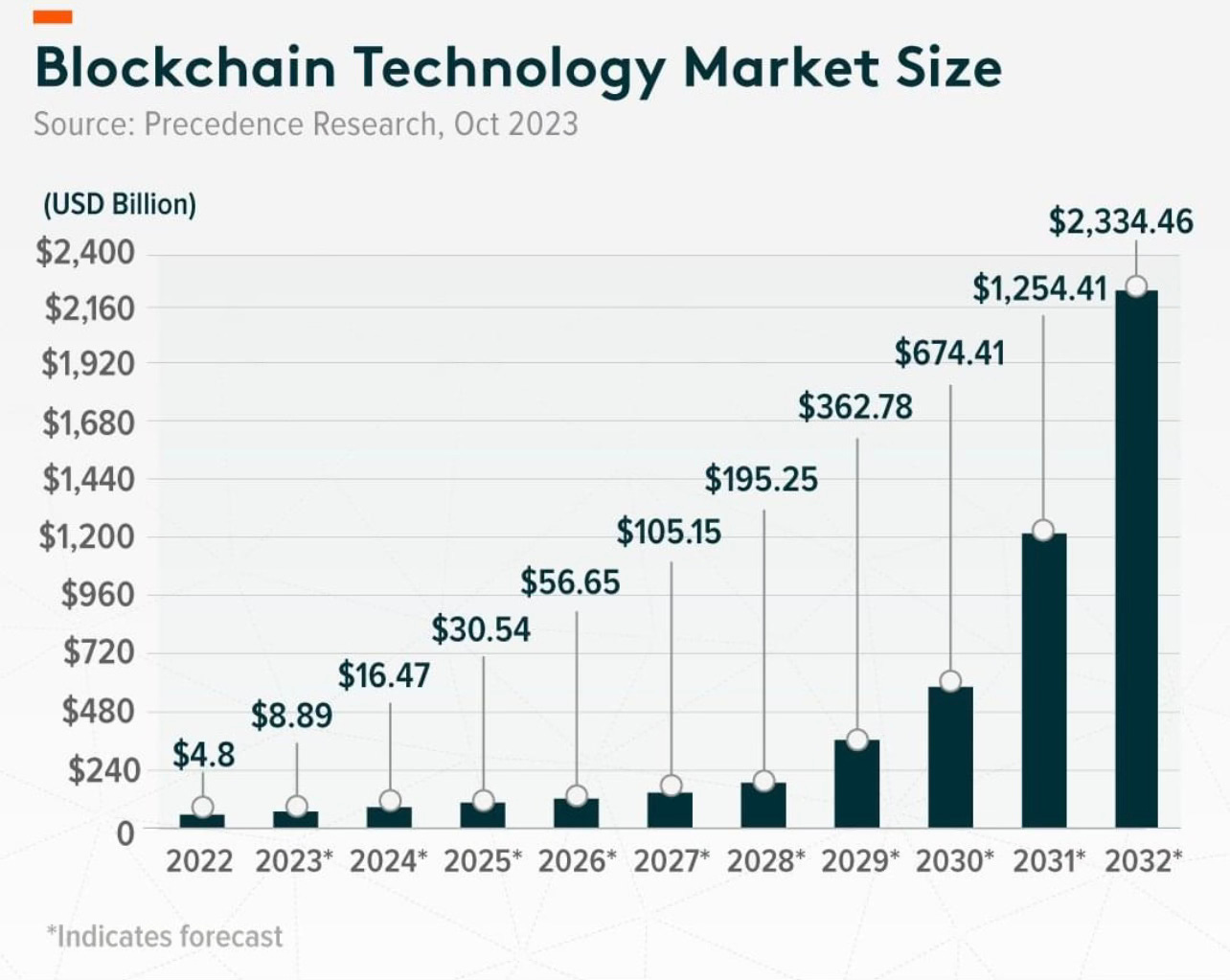

I can see why a number of Black Dawg Long Money Wrap subscribers are interested in blockchain:

This Day in History

In 1642, Isaac Newton, an English mathematician, physicist, astronomer, alchemist, theologian, and author, is born. While Newton is considered one of the greatest and most influential scientists in history, the same cannot be said about his investment prowess. "I can calculate the movement of the stars, but not the madness of men,” Newton said after succumbing to the ultimate case of FOMO with respect to shares in the great bubble of the day, the South Sea Company.

In 1887, Conrad Hilton an American businessman who founded the Hilton Hotels chain, was born. Hilton struck out for the oil fields looking to buy a bank, however, the bank owner raised his price at the last minute. Hilton retired to his hotel where he noticed that the place was booming, renting rooms by eight hour shifts and still turning away people. Hilton bought the hotel – the hotelier wanted to get into the oil game - and then went on to buy and build hotels throughout Texas. In the Great Depression, however, hotel traffic plummeted and Hilton lost all but one of his hotels, the El Paso Hilton. He almost lost that one but at the last possible moment he raised $40,000 from suppliers. Refusing advice to declare bankruptcy like every other hotel owner in the country, Hilton emerged from the Depression with a stellar reputation which enabled him to reclaim his empire and much more.

In 1905, Howard Hughes, an American aerospace engineer, businessman, filmmaker, investor, philanthropist, and pilot, was born. Much of Hughes’ vast wealth consisted of real estate including thousands of prime acreage in Las Vegas. Hughes’ real estate empire ultimately became the Howard Hughes Corporation. https://investor.howardhughes.com.

One thing Hilton and Hughes have in common is that they are both core holdings for Bill Ackman’s Pershing Square Holdings. One of the top performing managers over the last 5 years, Ackman runs a highly concentrated portfolio of just 7 stocks. As Chair and 10% owner of Howard Hughes Corp., Ackman has been buying $HHH shares in the open market on an almost daily basis for months. He says the stock is worth $170 a share. http://openinsider.com/HHH.

What do Ackman’s investments have in common? They are typically in simple, predictable companies with a dominant market position that generate high returns on capital and free cash flow. He often makes bold, contrarian moves, investing in companies that he believes are undervalued by the market.

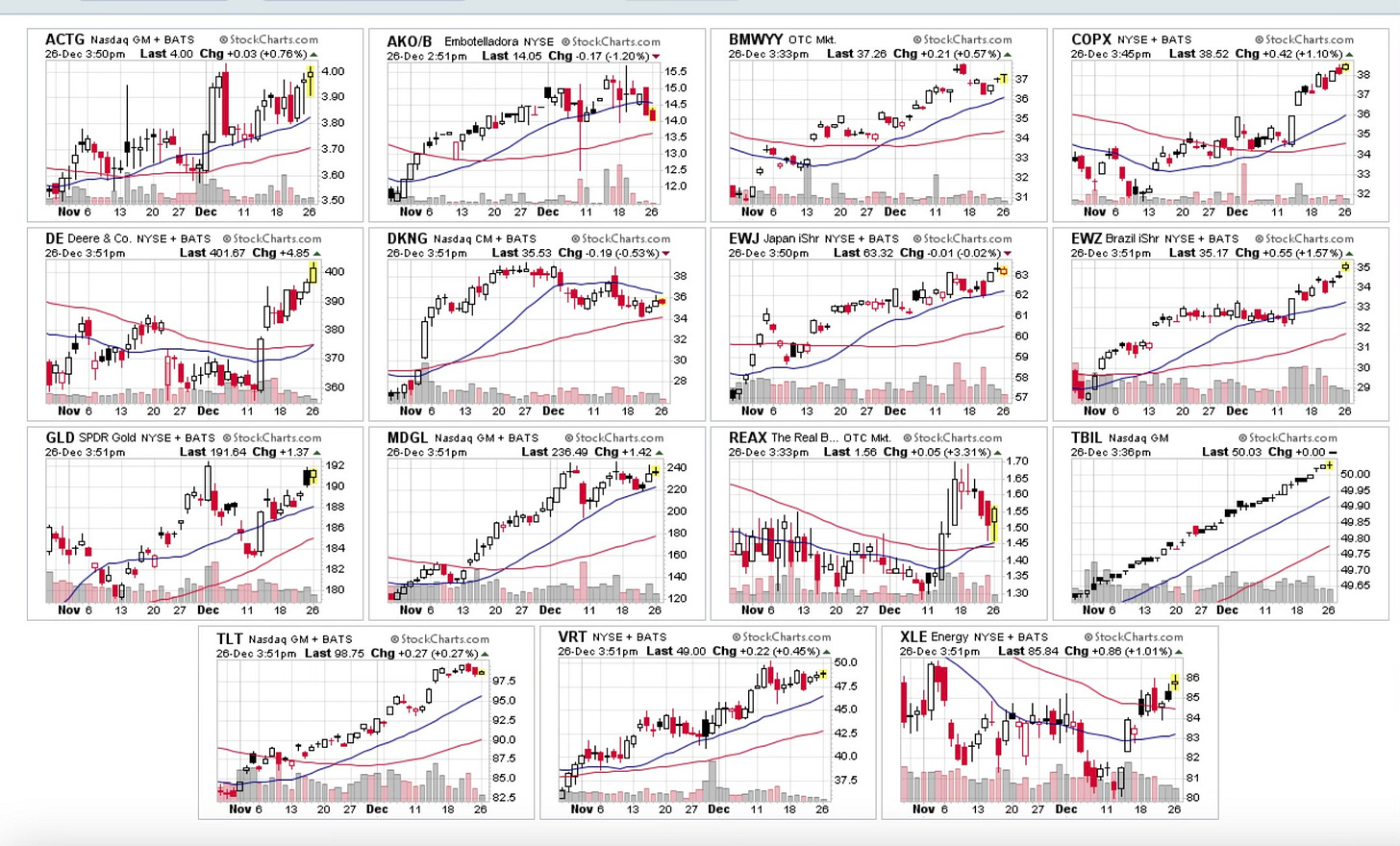

Black Dawg is running with 2x as many investments:

In 1947, heavy snow blanketed the Northeast, burying NYC under 25.8" of snow in 16 hrs. The winter of 1947 was bad in Europe as well, causing widespread hunger in post-war Germany. https://postwargermany.com/2012/09/26/hunger-winter/.

Behavioral Economics Principle of the Day

Fear of Missing Out (FOMO): The anxiety or fear that one may miss out on a rewarding experience or opportunity, often driven by social comparison or the desire to be included. It can lead to irrational behavior by causing individuals to make impulsive decisions or follow trends without considering their long-term consequences.