There's Something Happening Here, But What it is Ain't Exactly Clear

Well there’s a rose in a fisted glove; And the eagle flies with the dove… - Stephen Stills Love the One You’re With.

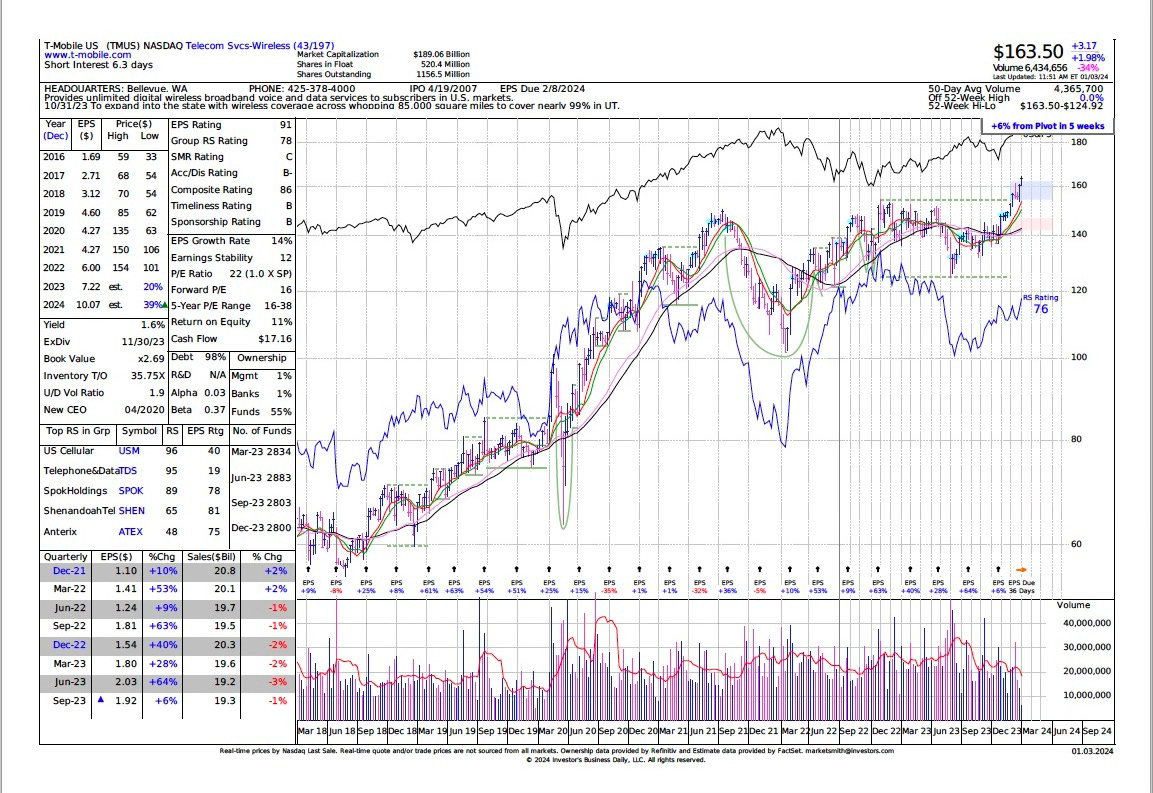

T-Mobile TMUS 0.00%↑ gained for a second day notching an all time high. All time doesn’t necessarily mean expensive. The stock trades at 16x next years estimated earnings which would be its lowest PE in last five years. Earnings are seen accelerating in ‘23 and ‘24 as benefits of their merger with Sprint and large investment in 5G begins to pay off. Barron’s says it’s the TMT stock of the year for 2024. https://www.barrons.com/articles/t-mobile-best-telecom-stock-2024-1cc8cb06?st=xqvqf5tdfelrc29&reflink=desktopwebshare_permalink.

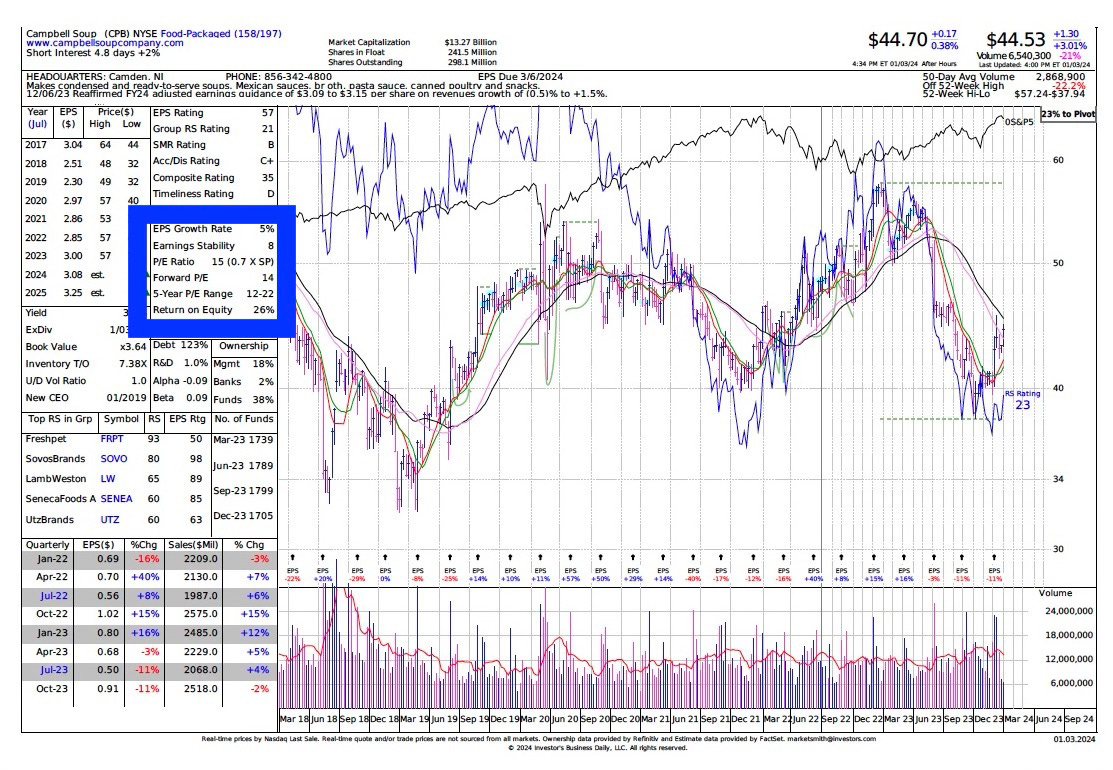

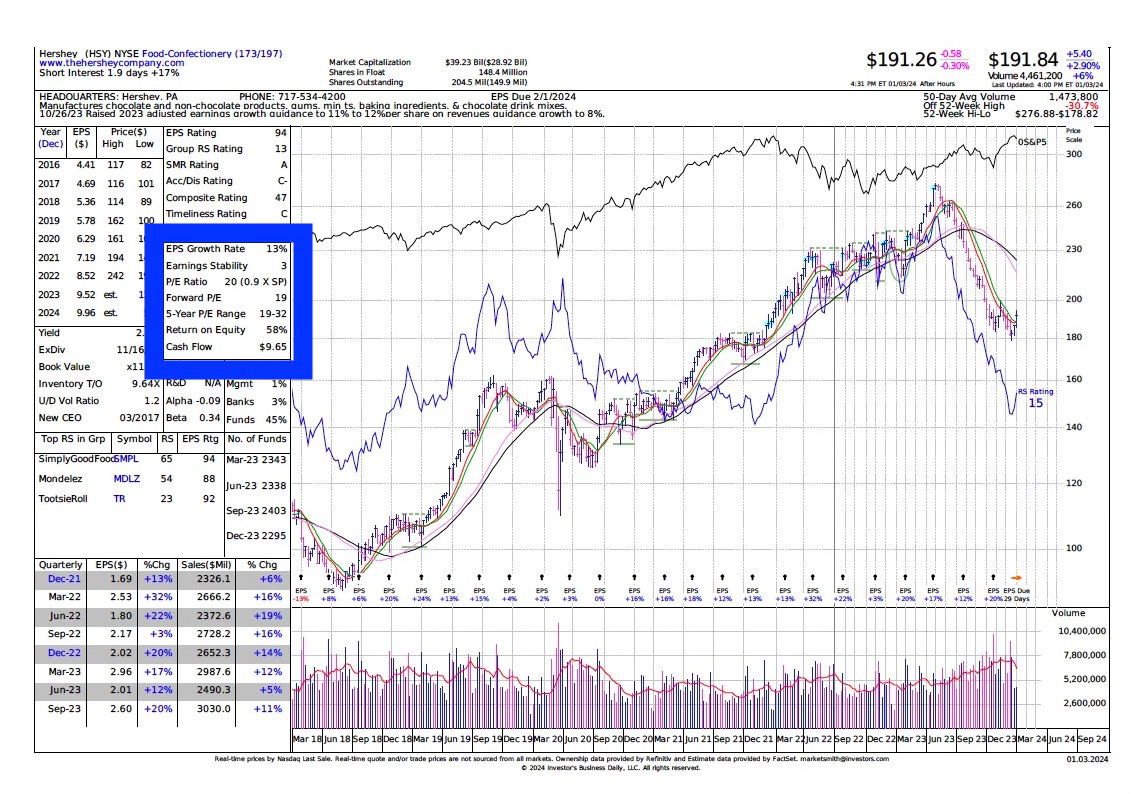

Speaking of 5 year PE ranges, a number of consumer staple stocks are trading at or near their 5 year low PE. Blackdawg thinks PE range can be a helpful indicator of investor sentiment which explains a lot of stock variability (ie how much investors are willing to pay for each dollar of earnings). See e.g. Campbell’s CPB 0.00%↑ and Hersheys $HSY.

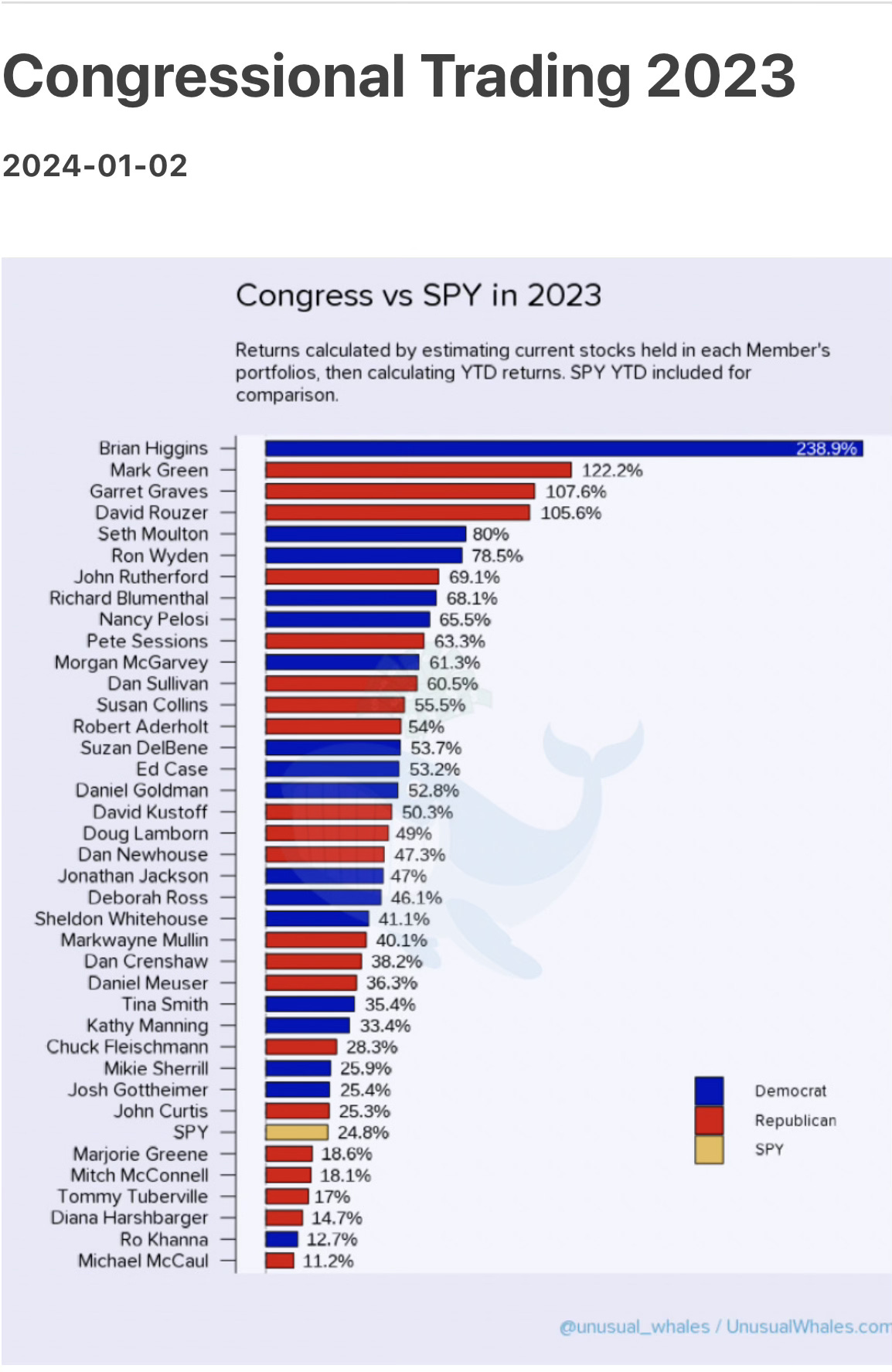

If you are in Congress, want to make some extra cash, but don’t want to sell out to Qatar… https://nypost.com/2024/01/02/news/menendez-hooked-up-bribe-paying-businessman-with-qatari-officials-feds/…believe it or not its still legal for Congress to trade stocks including shares of companies they regulate.

Probably nothing to worry about…Taiwan Spots Four Chinese Balloons Over Island as Poll Nears. https://www.bloomberg.com/news/articles/2024-01-03/taiwan-spots-four-chinese-balloons-over-island-as-poll-nears.

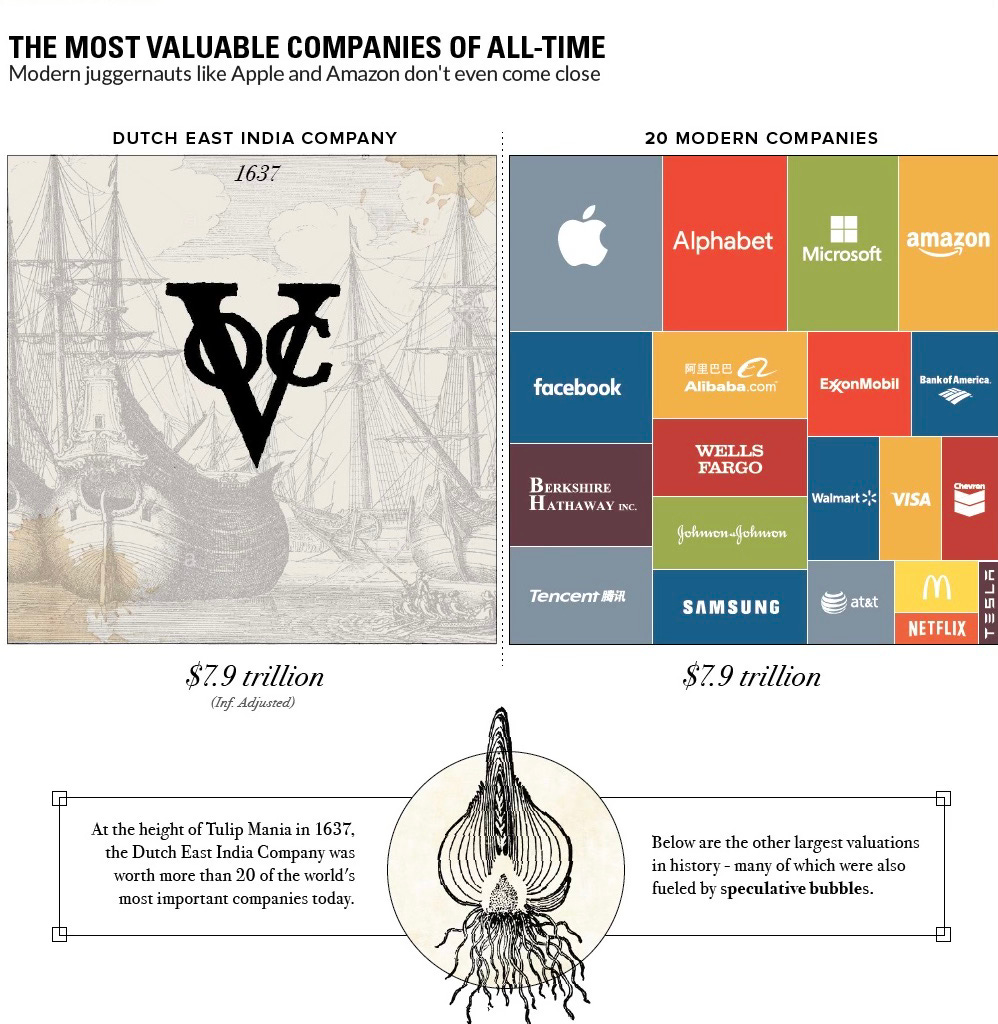

Much has been made of the outsized success of the so called Magnificent 7 stocks and their large market capitalizations. Blackhawg has been hesitant to call this a bubble given that they are also the most profitable companies with the largest profit margins. Apparently the advantages of scale and network effects > than the law of large numbers. AI, with the most benefits accruing to the largest companies (who have the resources for the massive investment required), should only exacerbate their advantages. Antitrust regulation or a lack there of may be a factor and a risk although ironically may also unlock even more shareholder value as the sum of the parts on the largest companies are likely greater than their current valuations.

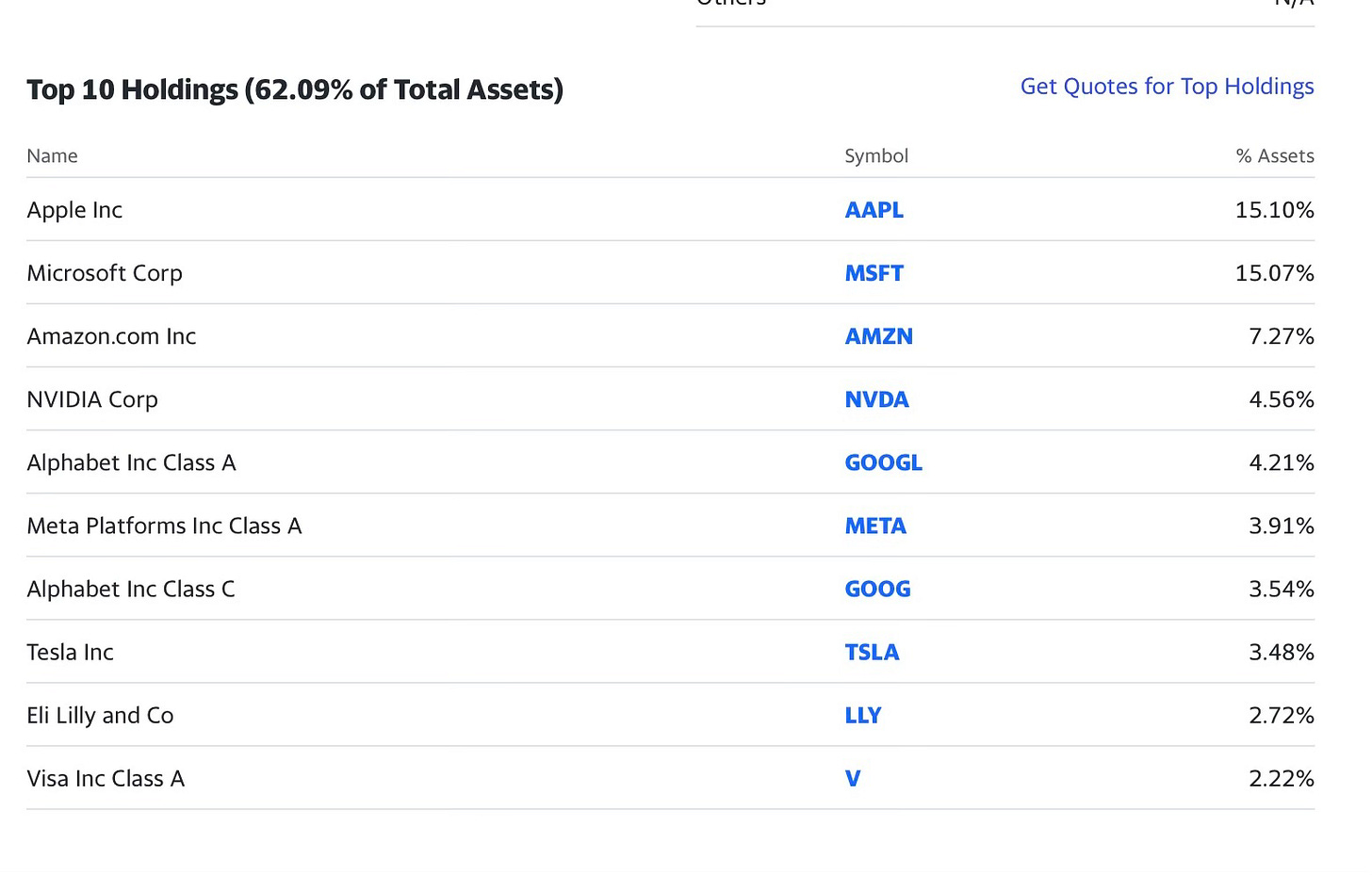

Blackdawg has no dawg in this fight and has managed to outperform despite no Mag 7 exposure, although he recommends checking out Vanguard’s Mega Cap fund $MGK (on weakness) if one feels compelled to participate and/or manage FOMO.

Here is some historical perspective on market dominance (slightly dated but still valid):

Oh, you think this is big? - Sam L Jackson, Ted 2

This Day in History

In 1977, Apple Computer, the world's largest company by market capitalization, is incorporated. Apple Computer Company was founded on April 1, 1976, by Steve Jobs, Steve Wozniak, and Ronald Wayne (WHO??) as a partnership. To finance its creation, Jobs sold his Volkswagen Bus, and Wozniak sold his HP-65 calculator. Apple Computer, Inc. was incorporated without Wayne, who had left and, in one of the worst decisions of all time, sold his share of the company back to Jobs and Wozniak for $800 only twelve days after having co-founded it. The company went public in 1980 for a split adjusted $0.10 per share.

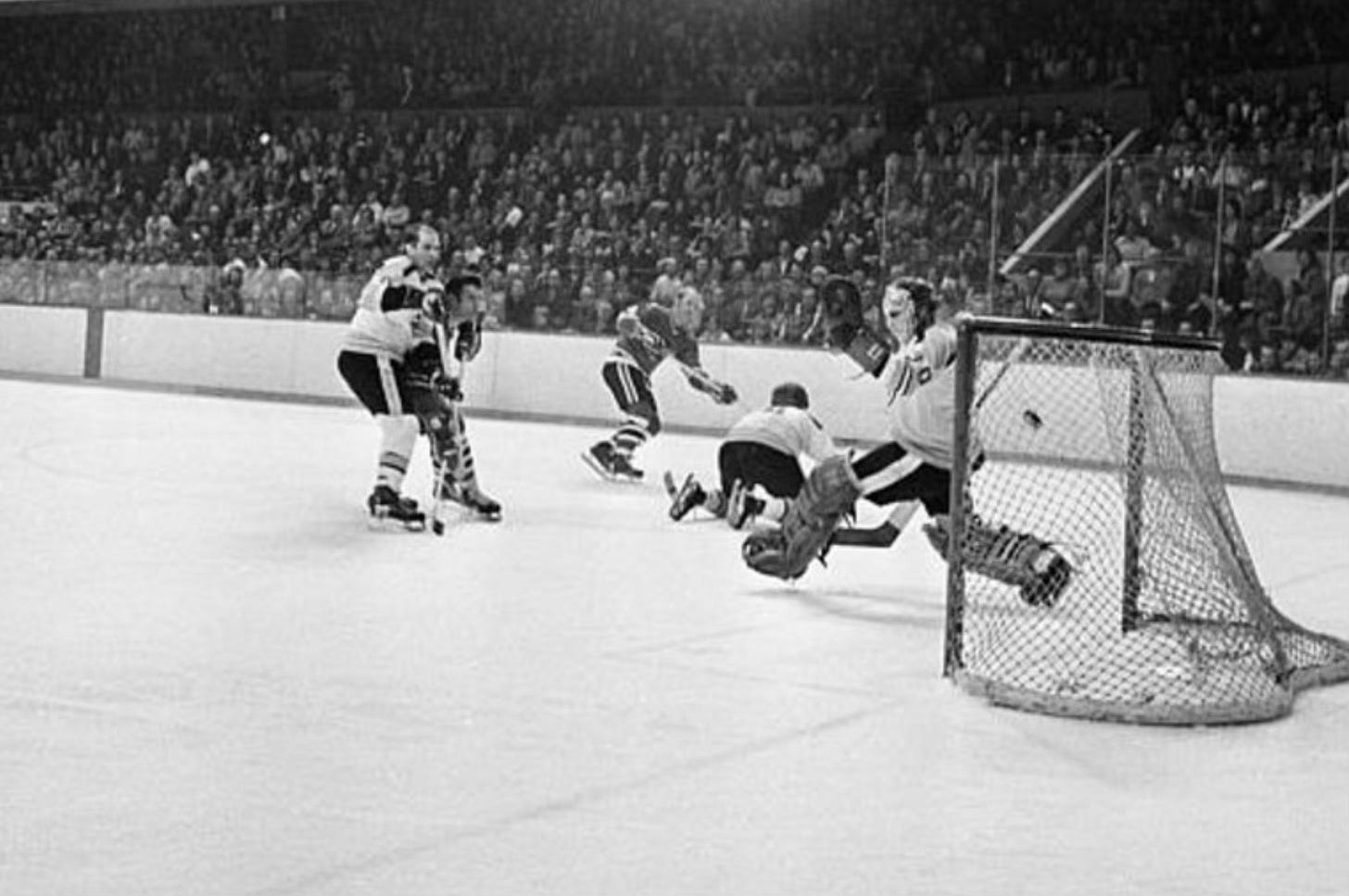

In 1939, Bobby Hull, who is widely regarded as one of the greatest players of all time, was born. His blond hair, skating speed, end-to-end rushes, and ability to shoot the puck at very high velocity all earned him the nickname "the Golden Jet". In 2017, Hull was named one of the '100 Greatest NHL Players' in history. Hull had one of the hardest slapshots of all time estimated at 116 mph - at a time goalies did not wear masks. Off the ice, Hull was noted for multiple domestic violence allegations, punching a cop and allegedly making comments supporting Adolf Hitler - something Blackdawg is glad he did not know when he cheered Hull playing at historic Chicago Stadium.

In 1945, Stephen Stills, American singer-songwriter and guitarist, best known for his work with Buffalo Springfield, Crosby, Stills & Nash, was born. Stills has combined record sales of over 35 million albums. Blackdawg saw him with CSN.

In 2003, Greta Thunberg, Swedish environmental activist known for challenging world leaders to take immediate action for climate change mitigation, was born and can now drink legally. Thunberg's climate activism began when she persuaded her parents to adopt lifestyle choices that reduced her family's carbon footprint. At age 15, Thunberg began skipping school on 20 August 2018, vowing to remain out of school until after the national Swedish election in an attempt to influence the outcome. Thunberg's youth and blunt speaking manner fueled her rise to the status of a global icon.

Thunberg, who has received numerous honours and awards, including inclusion in Time's 100 most influential people, being the youngest Time Person of the Year, inclusion in the Forbes list of The World's 100 Most Powerful Women, and multiple nominations for the Nobel Peace Prize.

Thunberg has disclosed that she is on the Autism spectrum. The stigma around autism can make it seem as though being on the spectrum is always something that negatively impacts a person’s life. But Thunberg has openly declared that there is nothing negative about her diagnosis, instead likening it to a superpower. “I have Aspergers and that means I’m sometimes a bit different form the norm,” tweeted Greta. “And – given the right circumstances – being different is a superpower.” Her stance on autism has earned her the support and admiration of many others on the spectrum. Many within the autism community have praised Thunberg for speaking openly about her autism and the advantages it brings, considering her an inspiration. In fact, scientific research suggest that autistic people can provide important neurodiversity that can enhance optimal decision making. It is theorized that their insulation from peer pressure and a difficulty in being untruthful may be key to the independence of thought that is a necessary element of maximizing the benefits of collective intelligence. Shout out to AI and collective intelligence expert, @Dr. Lorenzo’s Swarm podcast for that insight.

Behavioral Economics Principle of the Day

Recency Bias: The tendency to give more weight to recent events or information when making judgments or decisions. It can lead to irrational behavior by causing individuals to overlook long-term trends or patterns and focus excessively on recent experiences, leading to suboptimal decision-making.