Trade Peso, Yuan to Bet on US Elections: Citi; Blackdawg Says CFTC Should Allow Election Betting Instead

Week in Review

A stronger than expected Non Farm Payrolls report from the Labor Department this morning rocked pre-market trade but that turned out to be something of a head fake as the S&P 500 rose 0.2% on the day. Blackdawg doesn’t pay too much attention to the employment report because the monthly revisions that happen pretty much every month support the view that government data is neither accurate nor reliable.

Stocks and bonds both fell this week with the 10 year treasury note closing above 4%. Apple fell 6%. Factor-wise, value $IVW (+0.35%) significantly outperformed growth $IVE (-1.88%) while Healthcare XLV 0.00%↑ , highlighted in Tuesday’s Long Money Wrap as a top pick for 2024, gained 2.29% for the week.

While a down 1st week is often a negative sign for the month and year, Blackdawg believes “this time may be different” due to the scorching hot year end rally which may have pushed profit taking into 2024.

Legendary technical analyst Martin Pring is bullish at least for the first half although he said the bull market that started in 2009 is likely in its late stages. For now his many indicators are positive but not stretched.

Meanwhile Houthi Attacks on International Shipping Continue as Costs Soar

Maersk, which accounts for 1/6 of all global container shipping, is diverting all container vessels from Red Sea routes around Africa's Cape of Good Hope for the foreseeable future, warning customers to prepare for significant disruption.

The US is reportedly weighing imminent military action against the Iran-backed Houthis after the rebel group has ignored warnings and continued its attacks against international shipping. The Houthis have carried out 25 attacks against commercial ships since November and seized the Bahamas-flagged cargo ship Galaxy Leader and continue to hold the vessel and 25 members of its crew hostage. https://www.bloomberg.com/news/articles/2024-01-05/houthi-red-sea-attacks-us-retaliation-may-inflame-tensions-experts-warn?utm_source=website&utm_medium=share&utm_campaign=copy; https://www.fdd.org/analysis/2024/01/05/houthi-attacks-on-international-shipping-continue/.

While most assets fell this week, crude oil gained 3% on the increased geopolitical tensions. Counter-intuitively, oil fell at the outset of the Gaza war on the belief that the conflict would be limited in scope. However, given Iran’s sponsorship of multiple middle east terror groups, including the Houthis, oil markets may be reassessing the risk of a wider conflict.

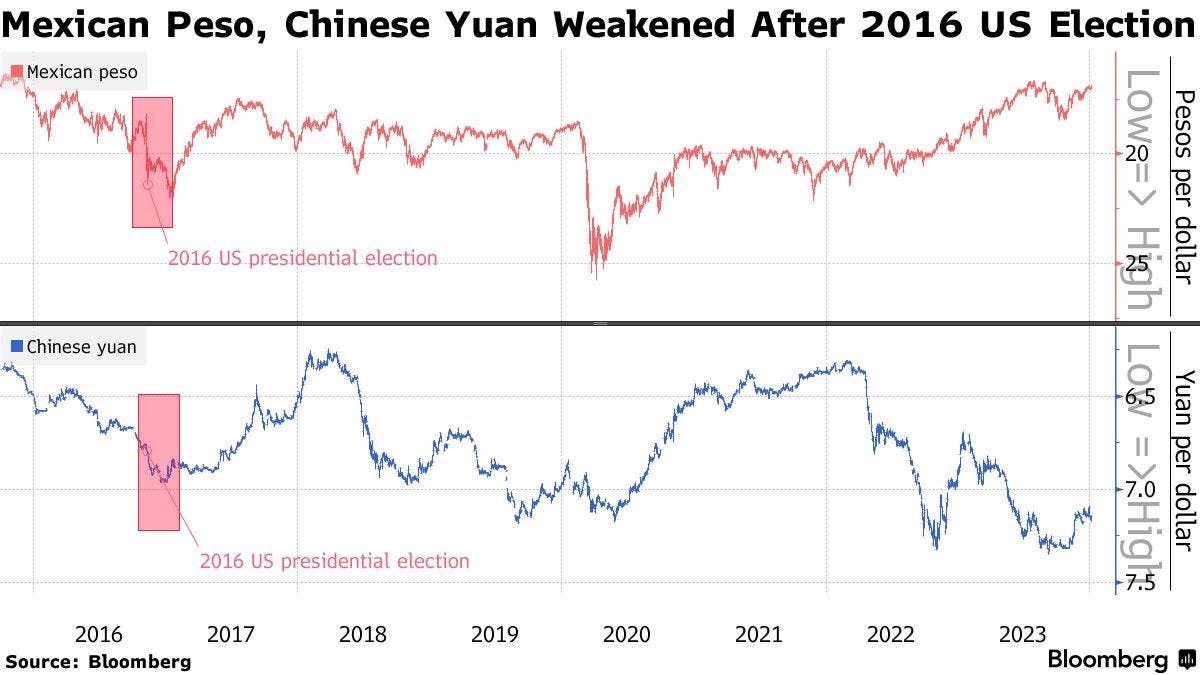

Citigroup: The Mexican peso and Chinese yuan are the best ways for traders to bet on the outcome of this year’s US presidential election. Both currencies are expected to have outsize reactions to the vote. https://www.bloomberg.com/news/articles/2024-01-05/use-mexican-peso-chinese-yuan-to-bet-on-us-election-citi-says?srnd=markets-vp

Even if one knew the election results ahead of time, there is no guarantee how the market will react. Ray Dalio, founder of Bridgewater Associates, the world’s largest hedge fund, told clients on the eve of the 2016 election that a Trump victory would result in the Dow falling what would have been a record 2000 points. He could not have been wronger. This is one of Dalio’s many bad macro calls over the years. Being oft wrong has not hurt the fund’s ability to gather assets, however recent poor performance is testing client patience.

Citi’s call raises the issue of why investors can’t simply bet on election results outright instead of having to identify supposedly correlated derivatives to express views and hedge risk. Historically, betting on US elections has been both legal and wildly popular going back to George Washington’s time. And it remains legal and popular outside the US. CFTC regulated event contract market Kalshi.com has proposed a contract enabling traders to bet on which party will control Congress. The CFTC, however, rejected that proposal last year saying that it constituted gaming, lacked economic purpose and would be against public interest. Kalshi sued the agency in federal court, arguing the decision was inconsistent with the Commodities Exchange Act and violated the Administrative Procedures Act. The matter is currently pending. https://business.cch.com/srd/20231101_KalshiEx-v-CFTC_complaint.pdf.

Speaking of prediction markets, Manifold, a play money prediction market, has the probability of Kalshi winning at just 22%. Blackdawg thinks this is too low, perhaps because there is no real skin in the game with play money. Expect Kalshi to appeal any loss as they are in this fight for the long term.

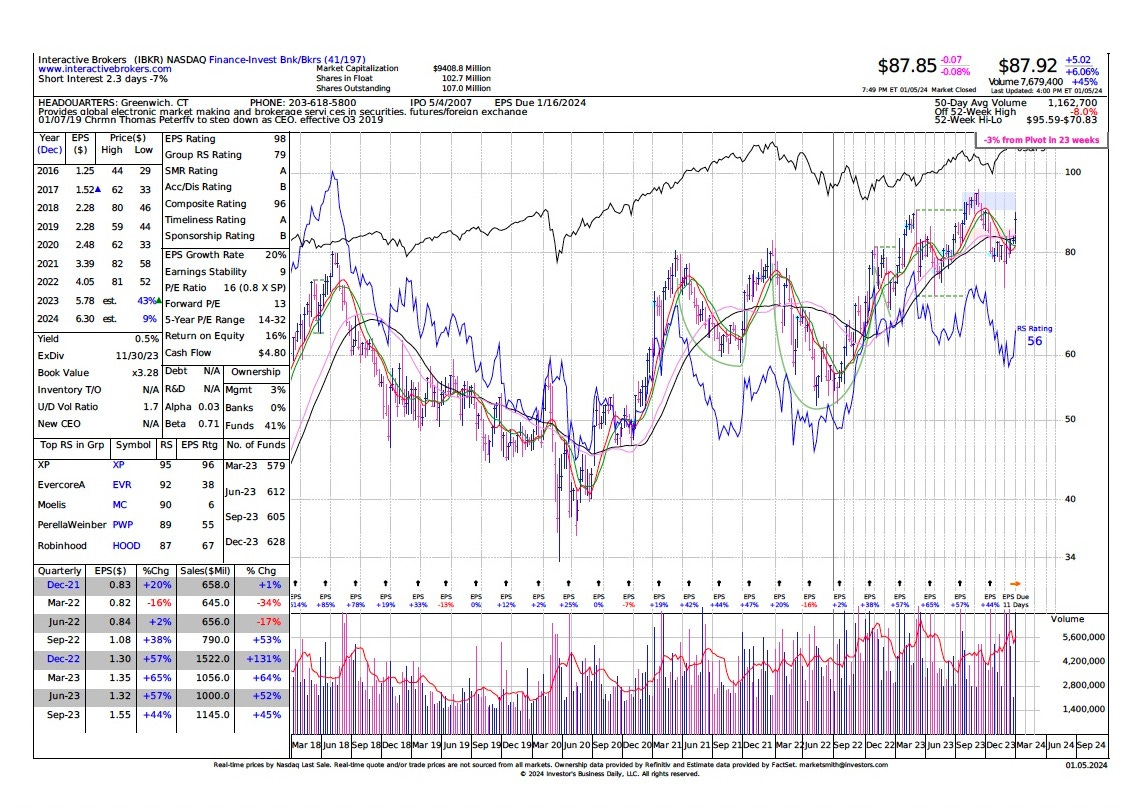

Interactive Brokers Group is a value play with 43% upside: Barron’s

$IBKR’s 2.5 million accounts—growing by more than 20% a year—are much smaller than Schwab or Fidelity - but their larger international business generates significant trading commissions unlike the zero commission model prevailing in the US. Payment for order flow, which supports the zero-commission trading model, is already or soon will be banned in Canada, the U.K., Australia, and Europe. IBKR generated $2.1 billion in pretax earnings on $3.1 billion of revenue in 2022 and has more than $9.4 billion in excess capital. The stock trades at just 13x 2024 earnings estimates which would be the lowest PE in 5 years. As with all broker-dealers, the most important factor in $IBKR’s performance will be the performance of the stock market. https://www.barrons.com/articles/atlanta-braves-comcast-iac-medtronic-value-growth-stocks.

Behavioral Economics Principle of the Day

Social Proof: The tendency to rely on the actions or opinions of others as a guiding factor in decision-making. It can lead to irrational behavior by causing individuals to conform to societal norms or follow popular trends without critically evaluating the underlying logic or evidence. Always best to do your own diligence before investing.